Why Bitcoin Exists (and It’s Not to Save You)

Why the Elites Want you Trapped in Bitcoin.

Why Does Bitcoin Exist?

Bitcoin exists to protect fiat. Fiat exists to trap you.

Together, they guard the only money they can’t confiscate through inflation, regulation, or digital switches: physical gold and silver in your possession.

This isn’t conspiracy; it’s the uncomfortable truth that is slipping through the fingers of the masses.

The Final Countdown

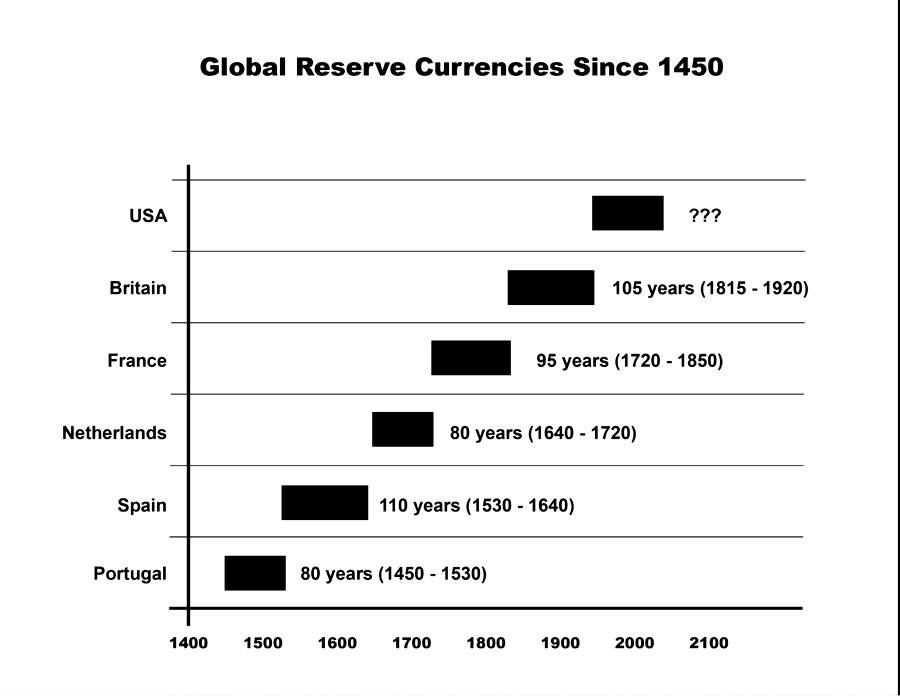

All global reserve currencies die. History shows they last about 94 years on average before being replaced.

Portugal: ~80 years

Spain: ~110 years

Netherlands: ~80 years

France: ~95 years

Britain: ~105 years

United States: so far, 81 years

The U.S. dollar became the world’s primary reserve currency in 1944 under the Bretton Woods Agreement, when other major currencies pegged to the dollar—and the dollar pegged to Gold.

That was 81 years ago. We are now deep into the final stretch of the historical reserve currency cycle.

The Fiat Era Is Already in Overtime

Fiat currencies last even less — just 27–35 years on average. The current regime began August 15, 1971, when Nixon closed the gold window. That was 54 years ago.

Those in power know the track is running out. Debt is unsustainable. Inflation is set to go parabolic. When confidence in fiat slips, collapse accelerates exponentially.

We’ve seen it before:

Weimar Germany, 1921–1923

Zimbabwe, 2000s

Venezuela, 2010s

When faith is lost, people flee to real stores of value — gold and silver.

And that’s where things get interesting.

Central Banks Are Not Buying Bitcoin

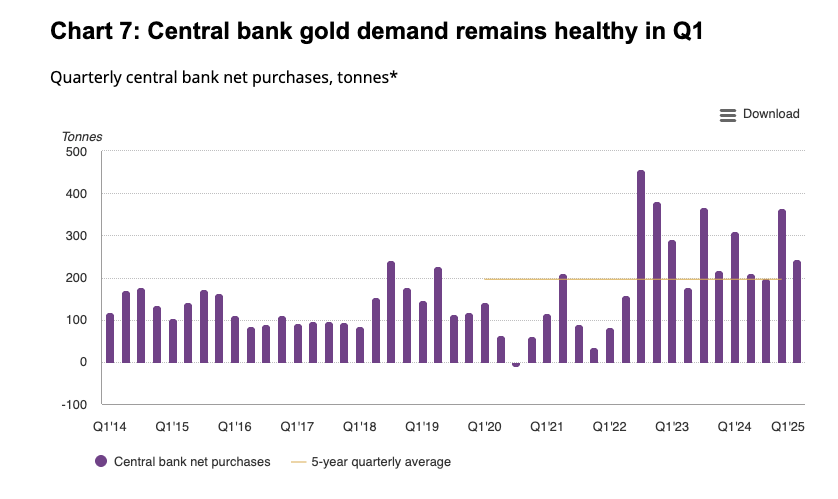

While the public debates crypto, central banks have been quietly buying gold.

Since 2010: Net buyers of physical gold.

2022: Record 1,100+ tonnes purchased — the most since records began in 1950.

2025: Emerging markets leading the charge.

If Bitcoin were truly “the future of money,” why are the world’s most powerful financial institutions hoarding the oldest form instead?

Because gold and silver remain the only true hedge against fiat collapse — and because they understand Bitcoin’s real purpose, which I’ll expose in the sections ahead.

The Problem They Face… The Solution they Offer.

As trust in the system began to erode after the 2008 financial crisis — and gold and silver kept climbing — central planners faced a serious problem:

How do they keep control over money creation when the public is losing faith?

The fiat regime depends on two pillars: maintaining faith in unbacked currency, and eliminating every viable, tangible alternative.

For decades, they kept precious metals under control through paper market manipulation. Suppressed prices slowed the stampede into gold and silver. But after 2008, cracks began to form, and the dam threatened to burst.

They needed a new decoy — something the public would believe was even better than gold. Something “shinier.” Something that looked like freedom but kept control in their hands.

A distraction to buy the dying monetary system just a little more time.

Enter Bitcoin: The Trojan Horse Liquidity Trap

If you’ve followed me on X/Twitter, you know I’ve called Bitcoin and cryptocurrency a trojan horse/liquidity trap for years. That’s exactly what it is, a pressure valve to keep capital inside the digital corral of the West’s legacy financial system.

Instead of Citizens fleeing to gold and silver—decentralized money you can hold in your hand—the public is enticed into a “new” asset that exists entirely in cyberspace. Lured by over pumped-up gains.

There, it can be tracked, regulated, taxed and—if necessary—frozen or censored. With the Fiat on and off ramps controlled, holders of this new asset class are at the mercy of the legacy system.

Bitcoin offers the appearance of an independent inflationary hedge, while keeping users tethered to a controlled, surveilled environment.

And just to seal the psychological link, its logo glitters like the very metal it seeks to replace.

The 2017 Handoff: How Bitcoin Was Altered

In its early days, Bitcoin aligned closer to the original whitepaper vision. That ended in 2017.

Bitcoin Core’s direction shifted under MIT Media Lab’s Joichi Ito — whose funding sources included Jeffrey Epstein’s network.

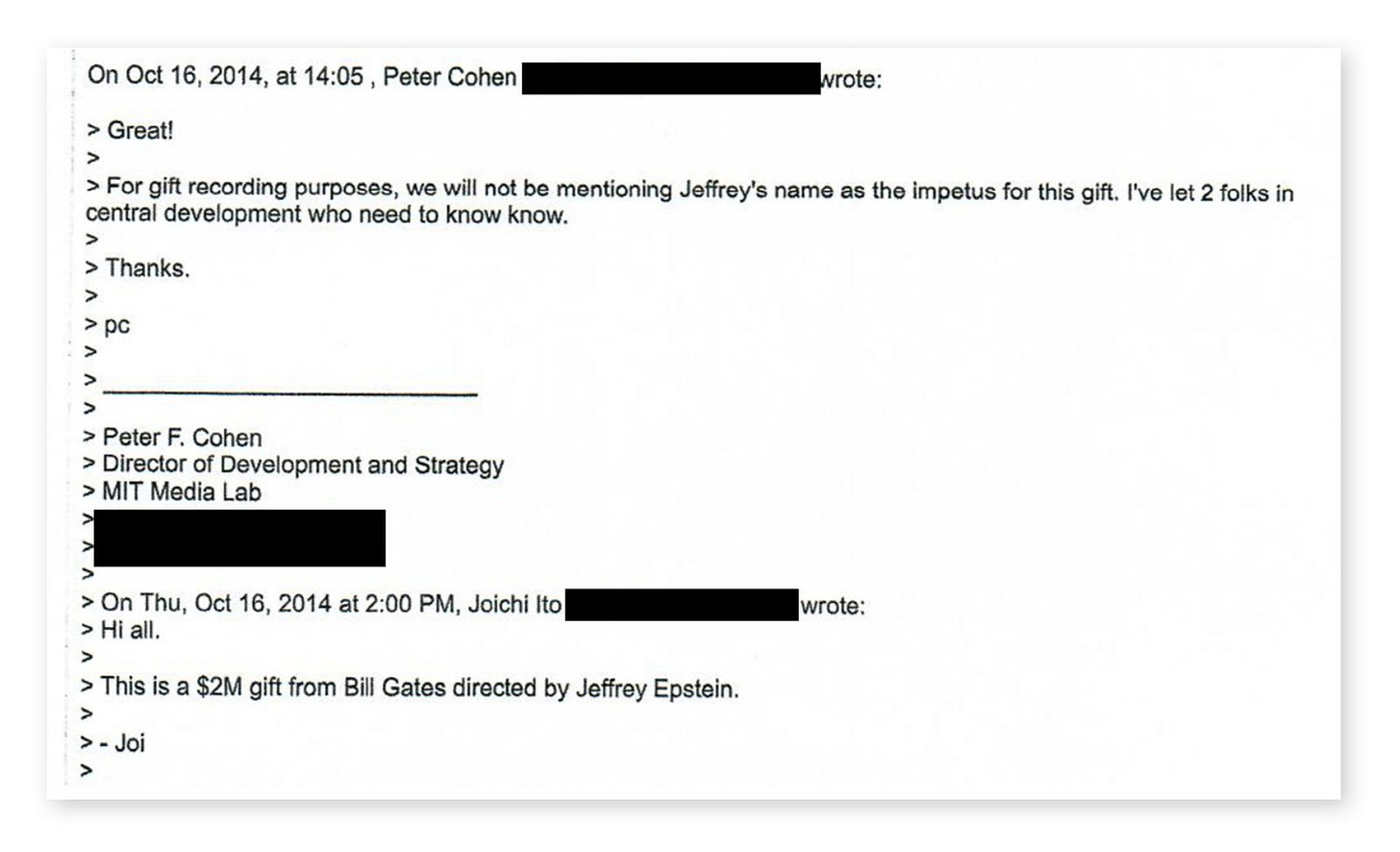

“In October, 2014, the Media Lab received a two-million-dollar donation from Bill Gates; Ito wrote in an internal e-mail, “This is a $2M gift from Bill Gates directed by Jeffrey Epstein.”

Cohen replied, “For gift recording purposes, we will not be mentioning Jeffrey’s name as the impetus for this gift.”

SegWit and artificial scaling limits ensured Bitcoin would remain slow, expensive, and dependent on second layers — locking it into the very system it was meant to “disrupt.”

The name stayed. The design was neutered. The grift became exorbitant.

Greed Weaponized: The Coming Rug Pull

In the coming monetary system transition, greed will be weaponized. Bitcoin is being fattened for the slaughter.

Its role now: hold the herd until the replacement arrives.

They need you trapped in stocks, bonds, and crypto. This is the great taking—a final rug pull where life savings evaporate at your weakest point. The same institutions that spent decades discrediting precious metals will now have everyone by the throat.

The stolen wealth from the old system will be funneled into the new one, marketed as an opportunity to reclaim what was lost. They’ll call it something like “stablecoin”, supposedly backed by tokenized gold.

But this was never about decentralization or sound money. It’s about total control: programmable, trackable, inescapable.

Inflation plus this great taking will pave the way for the next system. Universal Basic Income will appear as relief—but only on this new system, with price controls, negative interest rates, and Digital IDs.

The trap is not just technical—it’s psychological.

Ask yourself: do you really think they’ll give you early, easy access to the new monetary system?

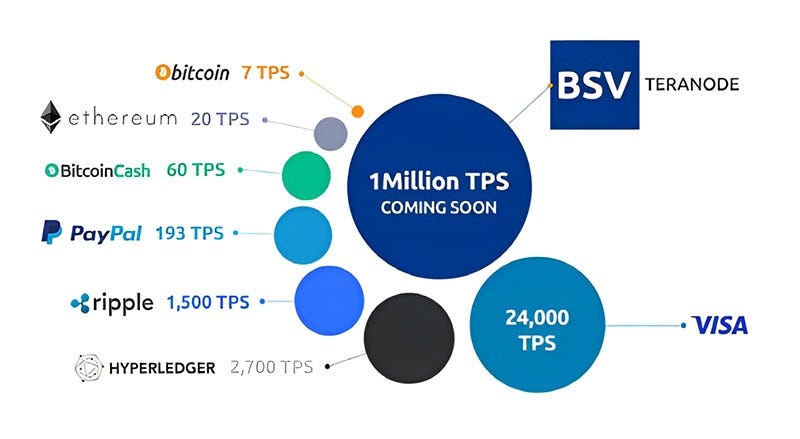

Ironically, the blockchain closest to the original Bitcoin design—proof-of-work with the highest TPS—isn’t BTC (Bitcoin Core). It’s BitcoinSV (BSV), now paired with Teranode.

The etymology is telling:

Terra = earth

Node = bind/tie

Teranode was formerly called iDaemon—an intelligent daemon system, designed to bind the earth. In other words, a system built to enslave, not liberate.

Enter the Dragon of Revelation

In biblical terms, BSV embodies the Dragon of the book of Revelation: global, powerful, and ready.

Here the dragon empowers the beast system, which is often interpreted as global centralized monetary/political control.

The beast that I saw was like a leopard; its feet were like a bear’s, and its mouth like a lion’s mouth. And the dragon gave it his power and his throne and great authority.” – Revelation 12:9

This confirms the dragon’s identity as the ultimate adversary, temporarily restrained before final judgment.

“And I saw an angel coming down out of heaven, having the key to the Abyss and holding in his hand a great chain. He seized the dragon, that ancient serpent, who is the devil, or Satan, and bound him for a thousand years.” – Revelation 20:1-2

Behind the tech-geek façade of the great chain (blockchain) lurks Abaddon the Destroyer, the angel of the abyss:

They had as king over them the angel of the Abyss, whose name in Hebrew is Abaddon and in Greek is Apollyon (that is, Destroyer). – Revelation 9:11

Central bankers crave total control. By tokenizing all assets on a globally scalable blockchain, they can capture every single transaction. Forced use of Digital IDs—the modern Mark of the Beast—gives them power over every facet of life:

“And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name.” – Revelation 13:17

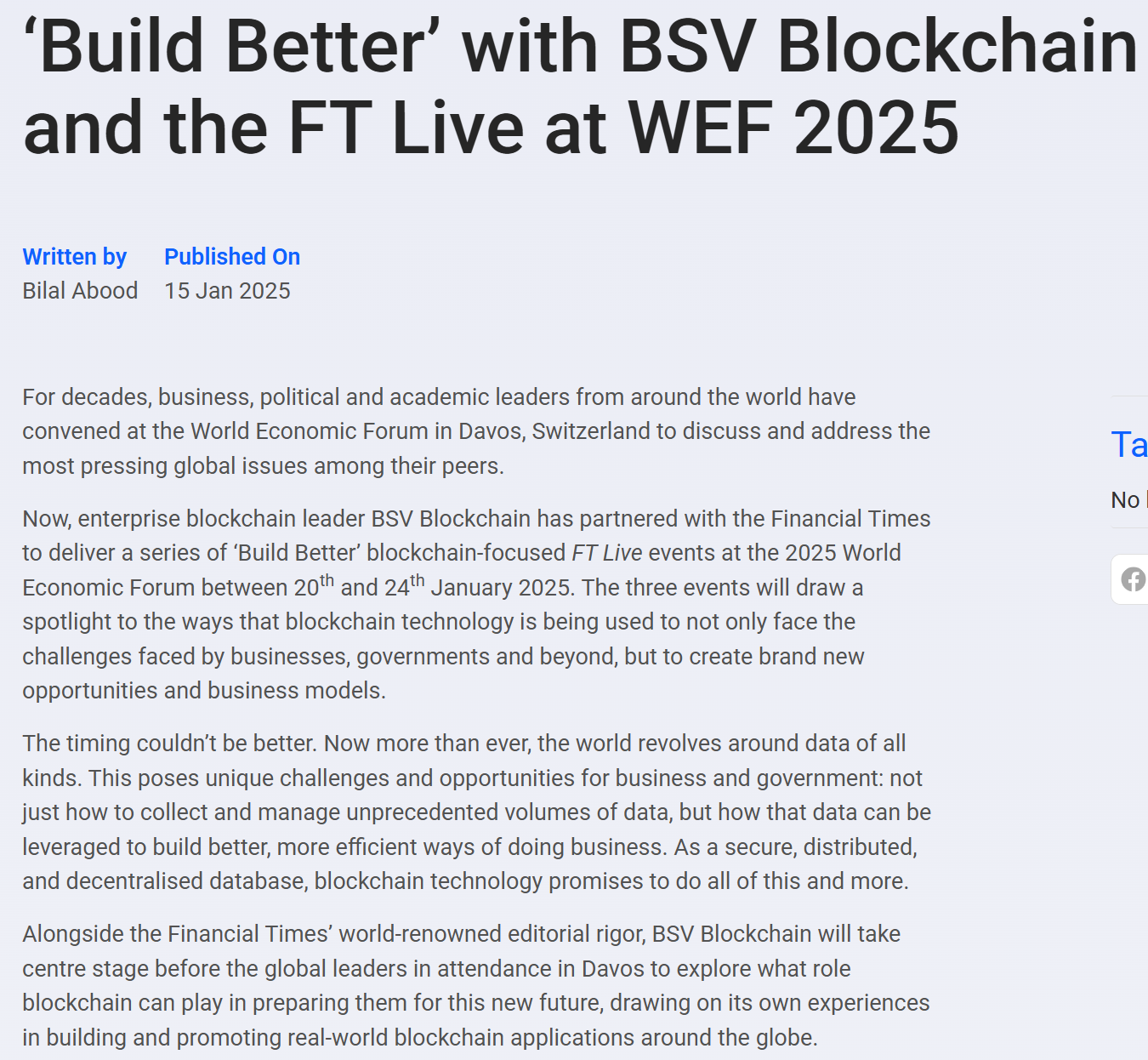

BSV stands as the only cryptocurrency compliant with WEF standards and was showcased at the World Economic Forum in Davos this past January.

This is the Digital Gulag, and BSV is the “Dragon” binding the earth with chains through teranode.

How the Rug Pull Plays Out

This is how it plays outs:

Satoshi’s BTC core wallet gets sold 👇

Profits rolled into BitcoinSV, which makes it’s price skyrocket 👇

USDT and "crypto" collapse 👇

Contagion Spreads & Global Economy collapses 👇

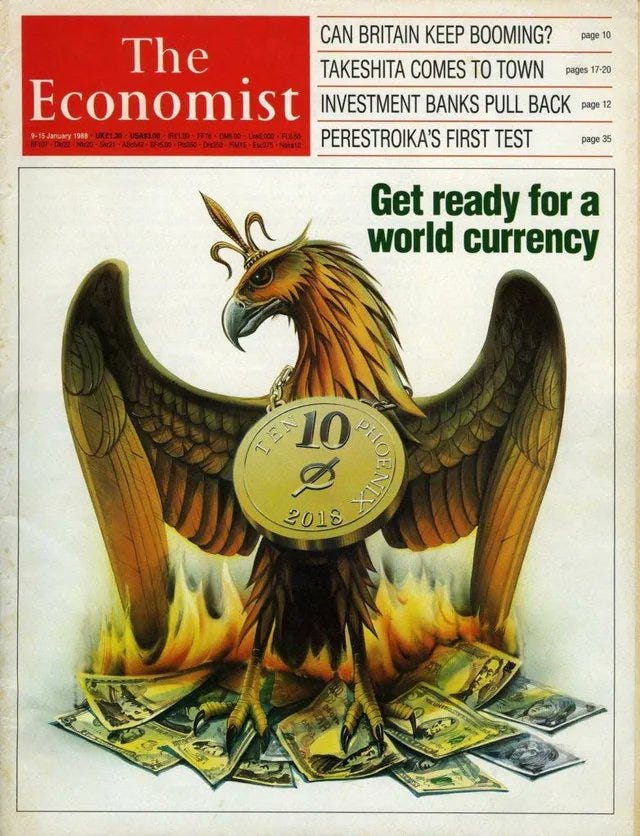

The Phoenix rises from the liquidity event caused by Satoshi 👇

A new world order (currency) rises from the ashes. 🐲

The Unanswered Questions: Evidence Bitcoin Is a Deep State Project

1. Why does Satoshi Nakamoto still have untouchable Anonymity?

Satoshi controls ~1 million BTC (worth $119.06 billion USD today) — untouched since 2011.

In U.S. history, every serious threat to the dollar’s dominance has been eliminated or neutralized:

Muammar Gaddafi — gold-backed dinar proposal — dead.

Saddam Hussein — petroeuro plan — dead.

Julian Assange — Wikileaks payment network — silenced and imprisoned.

Yet Satoshi remains immune to intelligence tracking in the world’s most surveilled era. This is not luck, it’s protection. His anonymity is not just tolerated; it’s safeguarded.

That level of invisibility requires state sponsorship.

2. Why is Bitcoin’s Algorithm using NSA patented technology?

Bitcoin’s “trustless” foundation rests entirely on SHA-256, a cryptographic hash function designed by NSA chief mathematician Glenn M. Lilly, patented in 2001, and preceded by a 1996 NSA whitepaper describing a Bitcoin-like system.

The NSA has a proven history of embedding backdoors into cryptographic standards (see Dual_EC_DRBG scandal). That Bitcoin’s security and mining depend 100% on an NSA algorithm is not a coincidence — it’s design architecture.

Bitcoin was built on NSA code, using NSA research, running exactly the kind of “controlled anonymity” system the agency theorized a decade earlier in a 1996 paper titled How To Make A Mint: The Cryptography Of Anonymous Electronic Cash.

3. Why is the biggest Bitcoin proponent headquartered next to the Federal Government?

Bitcoin’s most prominent promoter, Michael Saylor, is not a random entrepreneur:

His company is headquartered in Tysons, VA — a short distance from CIA and Federal Reserve facilities.

He is a federal contractor with a record of SEC fraud settlements.

He actively promotes Bitcoin as a strategic reserve for the U.S. to “crash enemy economies” — aligning perfectly with U.S. financial warfare doctrine.

Saylor’s role is not just evangelism, it’s state-aligned messaging.

4. Why does the West allow advertising and social media platforms to promote Bitcoin & Crypto?

If Bitcoin were truly anti-establishment, the U.S. would push one of the other 26,000+ cryptocurrencies out there. Instead, it backs Bitcoin indirectly via:

Surveillance: Public ledger makes every transaction traceable forever.

Control points: Regulated exchanges enforce KYC/AML, enabling freezes and seizures.

Strategic narrative: Marketed as “digital gold” to keep capital away from physical metals.

Institutional lock-in: BlackRock, Fidelity, and CME run custody, ETFs, and futures — the same Wall Street infrastructure that props up the fiat system. The same bad actors manipulating precious metals markets.

Final Thoughts from the Rabbit Hole

As fiat currency is further debased, so too is the soul of man. Bitcoin presents itself as a glimmer of “hope”—a new get-rich-quick gospel, led by savior-like figures such as Michael Saylor. A “messiah” who preaches kidney sales and promises that “bitcoin fixes this.”

Everywhere you look, Bitcoin is being advertised. Social media funnels the herd deeper into crypto. Logos dominate the UFC octagon. Young people gamble their life savings on digital assets. Even the President of the United States has released “shitcoins” alongside his family.

Where were the Super Bowl commercials for Gaddafi’s gold-backed dinar?

Any genuine threat to the global monetary system would never be allowed to be so brazenly burned into the public consciousness.

Bitcoin did not slip past the U.S. security state—it came from it.

From its NSA-coded backbone to its “anonymous” creator and Wall Street custodians, Bitcoin is not kryptonite to fiat power—it is a Trojan Horse Liquidity Trap, a temporary software update designed to herd capital in ways that benefit the system.

What’s worse: most people remain unaware that it is merely a placeholder for the real Beast system. Many will not see it until the gift horse opens the gates, and blood spills into the streets.

Stay vigilant,

—Tyler

💬 Your turn: Do you believe Bitcoin is a Trojan Horse, or do you think it’s truly the future of money? Drop your take in the comments — I’ll be reading and responding.

I had it down as a gateway drug to the digital gulag ever since the CBDC picture emerged.

Since they control the on/off ramp to cryptos, you'd need to convert to "legal tender" to actually spend any of it, which means you'll be converting to CBDC or the CBDC by another name stablecoins. The Programmable digital money gulag, leading to:

Negative interest rates without bank runs since you can't withdraw it and hide it under the matress.

Geo fenced spending ability, think lockdowns where you're not allowed more than 5 miles from home or your 15min city, go too far and your money is unspendable.

Time limited money to control the velocity of money, e.g. spend it in 30 days or it goes poof from you digital wallet.

Spending ability and automatic fines Linked to your social credit score (see the dystopian system Thailand is trying to impliment right now).

Linked to your Carbon allowance (mastercard has built the digital infrastructure for this already), can't buy that steak, or all that fuel for your car because you've run out of carbon credits.

It's a dystopian nightmare, globally, if we allow it. They need digital ID to be ubiquetous to pull this off, so that is the hill to die on, refuse to be assimilated, even if it's inconvinient.

Impressive post, thanks