The Great Monetary Gamble: How a Gold Revaluation Could Make or Break Bitcoin

Digital Gold, Dollar Debasement, and the Battle for Financial Sovereignty

Imagine a brave new world where the U.S. Treasury suddenly announces a radical revaluation of its gold reserves, jumping the official price from $42.22 to over $10,000 per ounce overnight. This move would significantly increase the Treasury General Account’s (TGA) dollar balance. What would they do with this newfound wealth? Many theorize that these newly created funds, could be used to inject liquidity into the economy, set up Gold Backed US Treasuries and purchase Bitcoin for a strategic reserve. In this scenario, what happens to the price of Bitcoin and crypto during this tectonic monetary shift? Drawing on expert insights and emerging trends, let’s explore three hypothetical scenarios—and the forces that could make them a reality.

Why Would the US Revalue Gold?

A gold revaluation isn’t without precedent. Historically, it’s been a tool to restore confidence in the dollar during crises:

- 1933: President Franklin D. Roosevelt raised gold’s price from $20.67 to $35/oz to devalue the dollar and combat the deflation of the Great Depression.

- 1971: President Nixon severed the gold standard entirely, letting markets “revalue” gold freely.

Today, a looming debt crisis and collapsing dollar confidence could drive the U.S. to reprice gold, reducing the real burden of its $36 trillion debt. Such a reset would signal desperation—but also a bid to anchor the dollar to a tangible asset, attempting to reestablish trust in the system. For Bitcoin, this duality creates both risk and opportunity.

Evidence in Support of Upcoming Gold Revaluation:

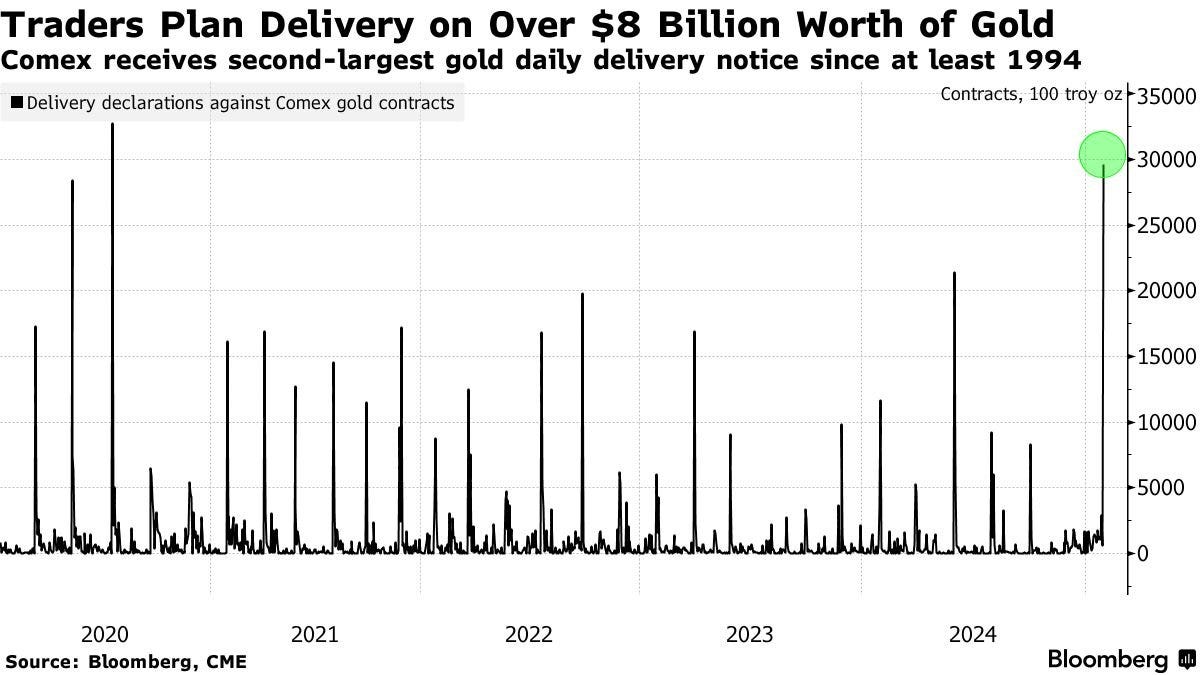

1. LBMA Gold Drain: The Bank of England’s inability to meet immediate gold delivery timelines—requiring 4–8 weeks to fulfill requests—has exposed metal shortages in London’s vaults, exacerbated by a 393-tonne transfer of LBMA gold to COMEX warehouses post-Trump’s election, signaling systemic strain

2. COMEX Delivery Surge: A big player (potentially the US Government) is standing for delivery at the Comex at 15X the normal volume. The second largest notice since 1994.

3. Rumors of Plans to Audit Fort Knox: While explicit mentions of Fort Knox audits have not been made official. Here is a recent tweet from President Trump’s Right-hand man, Elon Musk.

“It would be cool to do a live video walkthrough of Fort Knox.”

Is he alluding to an Audit?

Scenario 1: Bitcoin’s Safe-Haven Narrative vs. Short-Term Chaos

Initially, a gold revaluation may ignite a flight to safety, with investors scrambling for exposure to the newly "pumped" asset. Bitcoin, often cited as "digital gold," could face heavy selling pressure as capital rushes into physical or tokenized gold. In February 2025, we saw a brief preview: Bitcoin fell 6% amid inflation fears while gold surged.

Yet the revaluation’s inflationary implications—more dollars printed to match gold’s higher valuation—could reignite Bitcoin’s appeal.

Three Dynamics to Watch:

1. Safe-Haven Confirmation: Distrust in fiat systems could push tech-savvy investors toward Bitcoin’s “capped supply”.

2. Volatility Surge: A “sell everything” liquidity crunch might briefly sink the price of Bitcoin, but scarcity narratives could fuel a swift rebound.

3. ETF Inflows: Bitcoin spot ETFs (like BlackRock’s IBIT) could see record demand as institutions hedge with “digital gold.”

Price Impact:

- Short-Term (0–6 months): Panic-driven dip (10–20%), testing $90k support.

- Mid-Term (6–24 months): Recovery to $100k–$250k as safe-haven demand accelerates. Our next Target is specifically $122,668 🎯.

Scenario 2: The Strategic Bitcoin Reserve — A Cold War for Digital Assets

If the U.S. follows Arthur Hayes’ playbook, revaluing gold could free capital to build a Strategic Bitcoin Reserve. The proposed BITCOIN Act, treating Bitcoin like gold in national reserves, would gain urgency. Imagine the U.S. acquiring 1 million BTC (5% of supply), echoing MicroStrategy’s strategy at a national scale. The U.S. isn't the only one eyeing Bitcoin reserves.

Countries like Russia, Japan, and even the city of Vancouver, Canada, have considered similar strategies—underscoring a global push to step into the digital asset space.

Why It Matters:

- Legitimacy Boom: James Butterfill of CoinShares argues this could propel Bitcoin toward $1 million as demand outstrips supply.

- Liquidity Risks: Centralizing Bitcoin contradicts its decentralized ethos—mass government buys might strangle market liquidity.

- Institutional Surge: Pension funds and SWFs, already eyeing gold, could diversify into Bitcoin ETFs. For nations like El Salvador, doubling down on crypto reserves would become a sovereignty play.

Scenario 3: Tokenized Gold vs. Crypto — A Hybrid Financial Ecosystem

Gold’s revaluation would turbocharge real-world asset (RWA) tokenization, merging traditional markets with crypto markets and blockchain. Tokenized gold protocols like PAXG (up 6.6% in February 2025) would thrive, offering fractional ownership and DeFi yields. We are also starting to see the dawn of Real Estate tokenization with companies like RAAC with their Regna Minima NFT.

Who are the Winners in this scenario?

✅ Ethereum (ETH): A Bitcoin rally typically lifts Ethereum, while DeFi platforms attract those fleeing traditional finance.

✅ Tokenized Gold (PAXG, XAUT): Physical gold arbitrage could drive premiums, cementing crypto-gold hybrids.

✅ Privacy Coins (XMR, ZEC): Wealth preservation fears might boost demand for untraceable assets.

Who are the Losers in this scenario?

❌ Stablecoins (USDT, USDC): A gold-pegged dollar could destabilize collateralized stablecoins; algorithmic ones risk collapse.

❌ Meme Coins: Liquidity would drain from Dogecoin and peers into “harder” assets like Bitcoin.

Kevin Rusher of RAAC notes:

“Tokenized gold and Bitcoin aren’t rivals—they’re allies. Gold stabilizes, Bitcoin grows.”

⚖️ Geopolitical Curveball: Bitcoin’s Liquidity Trap

When the ruling powers that be recognize their monetary system is nearing the end, they engineer a liquidity trap—a deliberate mechanism to stem capital flight into hard assets like Gold, Silver and other commodities. Bitcoin embodies this trap: its price volatility is not random but a structural feature of its role in absorbing speculative demand and capital seeking refuge from inflation. It serves as a temporary pressure valve, sustaining the illusion of a store of value until a credible alternative monetary framework emerges. Once that occurs, Bitcoin’s perceived utility as a hedge against systemic decay collapses, leaving it irrelevant to the architects of the prevailing order. Now with the wealth of the masses ensnared on a digital ledger, they are free to install their technocracy. Power begets Power.

With this being understood, a gold revaluation would force foreign governments to reconsider their participation in crypto:

- Harsh Regulation: Capital controls, strict KYC, or outright bans could emerge to stem fiat outflows.

- Crypto Embrace: Alternatively, the U.S. most likely adopt crypto as a parallel system to absorb global capital, mirroring China’s digital yuan push.

- China’s Response would be Pivotal: doubling down on gold stockpiles? or cracking down on crypto to protect its economy? Meanwhile, Bitcoin-friendly nations like Brazil could continue to champion it as a tool for financial independence.

Coexistence or Conquest?

A U.S. gold revaluation wouldn’t kill Bitcoin—it would stress-test its role in a reshaped monetary order. Main takeaways:

1. Short-Term Pain, Long-Term Gain: Volatility would test investors, but Bitcoin’s scarcity could ultimately rival revalued gold.

2. Hybrid Finance Dawns: Tokenized gold and Bitcoin ETFs create bridges between old and new systems.

3. Regulatory Tipping Point: Pro-crypto leadership (e.g., a Trump administration) might fast-track frameworks for reserves and custody.

Long-Term Price Potential: If Bitcoin achieves gold-like reserve status post-revaluation ($10k/oz gold), its price could exceed $500k.

Who wins in the end?

Those who diversify across both worlds, leveraging gold’s stability and Bitcoin’s asymmetric upside. As we see throughout history, monetary resets breed chaos—but only from chaos, can new systems emerge.

Trump’s administration will likely pursue Scenario 2—strategical revaluation of gold plus aligning with Bitcoin as a monetary reserve/containment tool engineered by the entrenched Deep State Powers, they are allegedly in the process of “eradicating” through the Department of Government Efficiency. These new monetary structures—will be used to consolidate a systemic technocratic control, leveraging its role as a liquidity trap to ensure long-term financial and geopolitical dominance.

I remain skeptical that such a solution would be straightforward. Once confidence in the system fractures, it cannot be rebuilt through piecemeal adjustments to back US Treasuries, sporadic Gold revaluations or strategic Bitcoin reserves.

What incentive exists to hold long-term gold-backed U.S. Treasuries if they fail to ensure renewed trust? A coupon? Denominated in U.S. dollars?

How do you stuff the 50+ years of fiat currency debasement genie back in the bottle?

Most Importantly, How do we get countries globally to adopt Bitcoin as a new reserve system? Why would nations adopt a volatile crypto-asset as a reserve when the U.S. itself cannot credibly back its debt?

These contradictions alone render the efforts futile. In the end, all we can do is simply hedge our bets, and hope that the transition to the new system goes as smoothly as possible. Ultimately, we need a system that is fair, just, and based on sound money principles. A Bimetallic Blockchain system, with third party auditing would be optimal for building a new foundation of trust and evening the global playing field. The Earth is an abundant place, as we transition through these times, hopefully our leaders can see that a predatory debt-based system has no place in the future Golden Age of Humanity.

Stay Vigilant.

-Tyler