ONE LAST PUMP

How the Final Liquidity Cycle Will Reshape the Global Monetary Order

If this helps you understand what’s coming next in markets, share it. Most people still think the next pump is a bull market… not the final act of a monetary era.

Before Arnold Schwarzenegger became the face of modern bodybuilding, he was just a young Austrian training in a cold, bare-bones gym in Munich. No fame. No spotlight. No “advanced supplements”. Just iron, grit, bricklaying during the day, and a cot he slept on at night. He built his early strength the old-fashioned way: naturally, with discipline and hunger doing all the work.

But everything changed when he made the pilgrimage to Venice, California… to Gold’s Gym, the mecca of bodybuilding. Suddenly he wasn’t competing against local lifters anymore. He was standing beside giants. Expectations rose. The weights got heavier. The standard became superhuman.

And in that world, even Arnold… the genetic outlier… eventually turned to unnatural assistance to keep pushing beyond what the human body could achieve alone.

Not because he lacked discipline, but because the system demanded more than nature alone could provide.

That is the global monetary system today.

What began decades ago as organic economic growth… real productivity, real savings, real investment… slowly morphed into something else:

engineered credit

suppressed interest rates

deficit-driven expansion

financialization

emergency interventions

quantitative easing

The system kept lifting more weight… but only by relying on increasingly unnatural support.

And now, like Arnold under a bar loaded far beyond reason, muscles trembling as he forces out one last chemically-assisted rep…

The global financial system is preparing for One Last Pump… one final liquidity injection to keep the structure standing before something more fundamental must change.

This isn’t another QE.

It’s not a replay of 2008 or 2020.

This is the terminal liquidity cycle of the current monetary regime.

And just as the final rep of exhaustion changes the trajectory of the body, this last liquidity pump will change the trajectory of the global economy.

To understand what comes next, we must first understand the world around the pump… because this time, something is very different.

BRICS+ Just Broke the Script

While Western central banks prepare for another liquidity wave, major emerging economies are quietly building an alternative settlement rail outside the dollar system.

BRICS is now piloting a gold-linked trade settlement instrument known as “The Unit.” It is not a unified currency for everyday use. It is a cross-border clearing mechanism designed specifically to settle trade without relying on the U.S. dollar.

Under its proposed design, the Unit is structured as a hybrid reserve instrument:

~40% backed by physical gold

~60% backed by a basket of BRICS currencies

(yuan, ruble, rupee, real, and rand)

That structure alone marks a clean break from the post-1971 system. For the first time in decades, a major economic bloc is anchoring part of its settlement layer to metal instead of sovereign debt.

Even as a pilot, this matters.

Any settlement system that introduces gold into the clearing layer nudges the world toward:

greater reliance on metal as reserves,

less dependence on debt-based collateral,

and reduced blind trust in paper promises.

Now connect that to a hard reality:

Global capital markets are massive.

Physical metals markets are tiny.

With global bonds and equities exceeding $250 trillion combined, it takes only a small reallocation into physical settlement collateral to force violent repricing in metals. This isn’t narrative-driven… it’s arithmetic.

And the physical market is already tight. Much of the visible silver supply is encumbered through leasing and allocation rather than freely deliverable metal. Large projected supply deficits later this decade mean the paper market’s flexibility is masking a very rigid physical reality.

This is what changes the meaning of the next liquidity wave.

In 2008 and 2020, new liquidity had nowhere to go but back into the same dollar-based financial system.

This time, a parallel, partially metal-anchored settlement layer already exists.

So the next wave of liquidity won’t just inflate stocks and bonds.

It will accelerate monetary fragmentation.

Not a collapse.

A collision between two systems:

one built on leverage and paper claims,

the other rebuilding around settlement, collateral, and metal.

If you’re new here, subscribe to Grey Rabbit Finance for deeper breakdowns of global liquidity, precious metals, and regime shifts.

📈 1. Stocks: Melt-Up First, Rotation Second

When liquidity comes roaring back, equities will be the first responders.

Phase 1: The Melt-Up

Expect:

SPX & QQQ breaking to new highs

Breadth widening

Small and mid-caps ripping

Volatility collapsing

Passive flows magnifying every move

This is the market front-running liquidity… not earnings.

📊 Global M2 Money Supply vs S&P 500

Every major equity bull phase of the last 25 years has been preceded by a turn higher in global liquidity. The S&P 500 doesn’t lead money… it follows it. Each vertical move highlighted here corresponds to a renewed liquidity surge after policy stress. Today, price sits in compression again as the next liquidity wave builds beneath the surface. This is the setup for One Last Pump.

Phase 2: The Sorting

Once investors realize liquidity is being deployed to preserve the government, not to stimulate growth:

High-multiple tech derates

Cash-burning growth weakens

Commodities, energy, and value outperform

Defensive sectors strengthen

Liquidity lifts the market.

Regime change decides who keeps the gains.

If you’re finding this breakdown valuable, share it with someone who needs to understand where we’re heading.

💵 2. Bonds: The Endgame of the Long Bond Era

We’ve reached the point where the government can no longer normalize interest rates without destabilizing itself.

Debt service now grows faster than GDP.

Foreign buyers have stepped back, in favor of safer assets (Precious Metals).

The Treasury market requires permanent “liquidity facilities.”

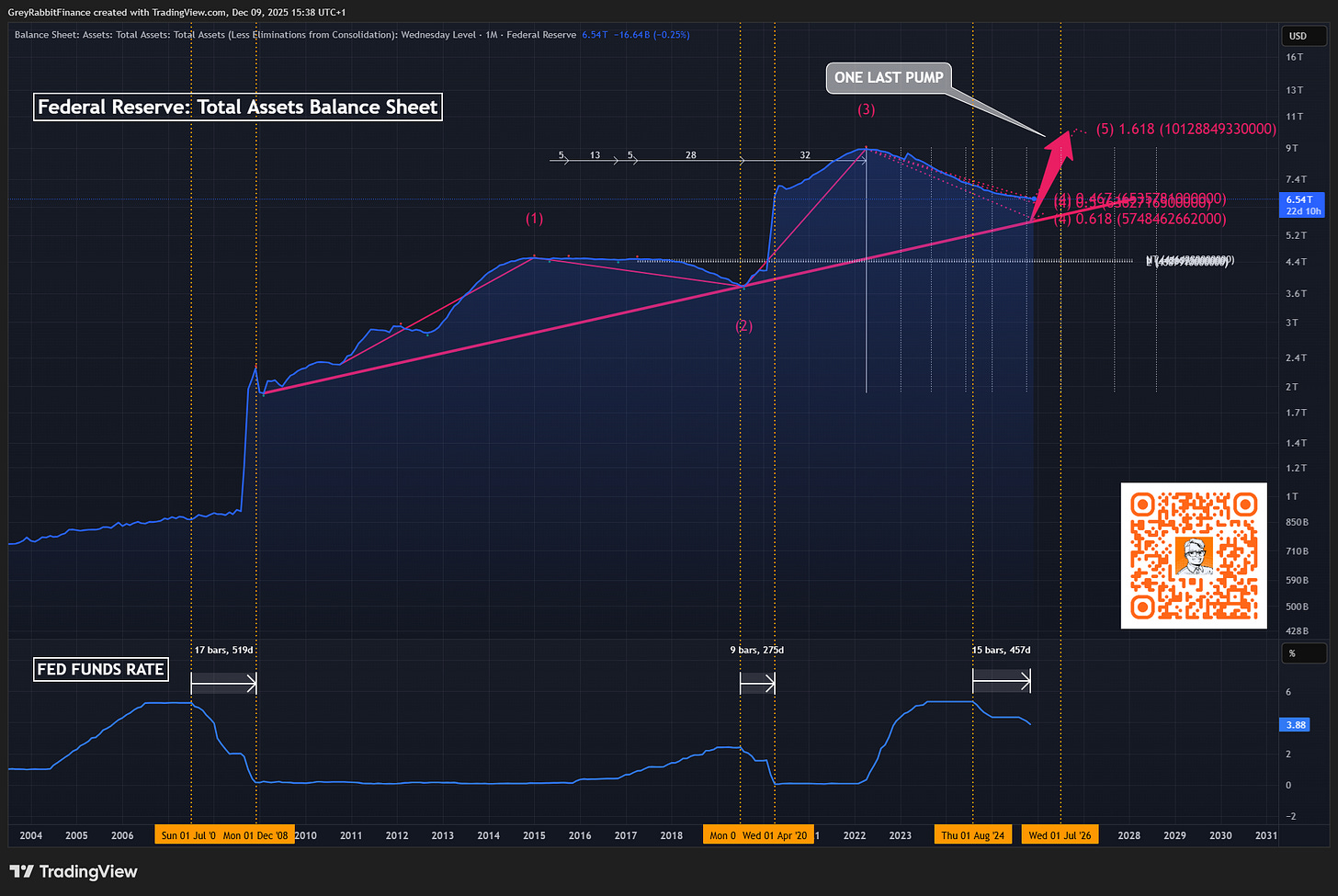

📊 FED Total Assets Balance Sheet + FED Funds Rate

Every attempt to shrink the Fed’s balance sheet has followed the same script: tightening begins, financial stress emerges, and policy reverses back toward expansion. The recent QT phase has again compressed liquidity into a narrowing range. The projection shown here reflects the historical pattern… contraction gives way to a final, larger expansion. This is the mechanical basis for One Last Pump.

What this chart makes clear is that QT is not a destination… it is always a phase. Each time the balance sheet compresses, the system destabilizes under the weight of its own debt structure. The response is never austerity. It is always a return to liquidity.

The projected trajectory here reflects the same reflexive pattern that followed 2008 and 2020… only this time, the scale required to stabilize the system is meaningfully larger.

Expect:

Long-duration bonds to get crushed

Yield curve control (without using the name)

Real yields driven deeply negative

Nominal yields politically constrained

The 60/40 portfolio to fail structurally

Bondholders become the shock absorbers (bag holders) of the transition.

🏡 3. Real Estate: A Two-Speed Market Ahead

Real estate can rise in dollars while falling in real money… and that divergence widens during currency transitions.

Real estate will not behave as a single asset class in the coming liquidity cycle. It is already splitting into two separate markets: one propped up by policy and inflation psychology, and one slowly being repriced by leverage, vacancy, and cash-flow reality.

Residential Housing: Nominal Support, Real Dilution

Residential property will likely be supported in nominal terms, even as real purchasing power continues to erode.

Support comes from:

policy-driven mortgage intervention

institutional and foreign buyers

restricted supply in select metros

inflation expectations anchoring seller psychology

But this support is deceptive. When priced in hard money, housing does not look strong.

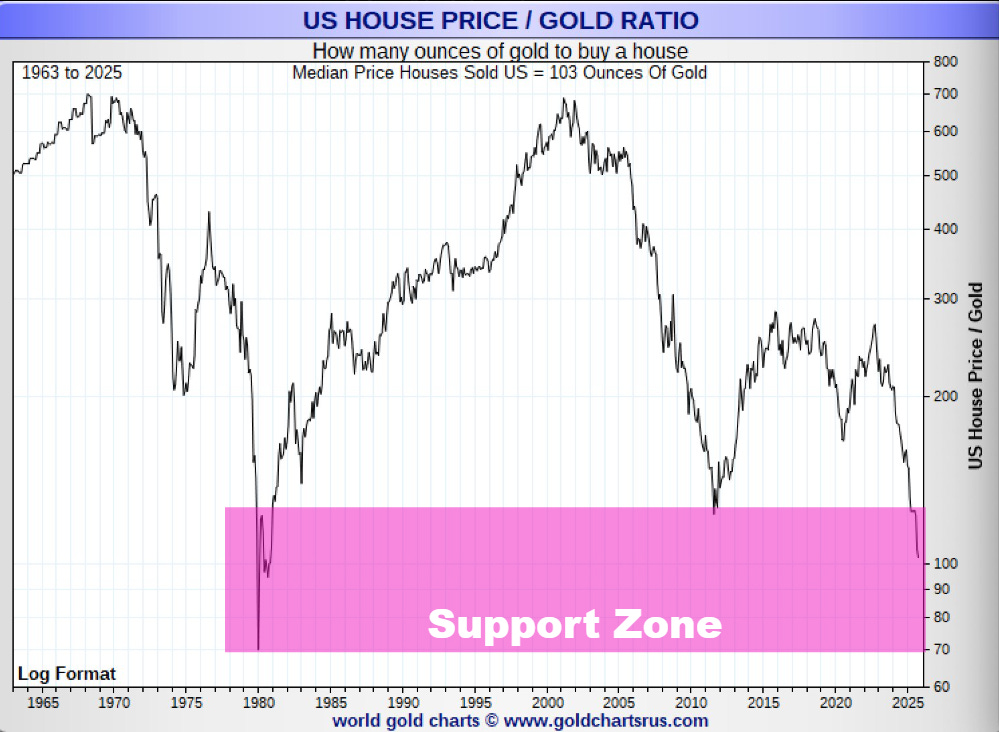

📊 U.S. Housing Priced in Gold (1963–2025)

Every major monetary reset drives this ratio into the 70–130 oz support zone, where housing historically finds its hard-money cycle low (1980, 2011). Today, the ratio is once again descending toward that same structural floor signaling that housing is weakening in real terms even as nominal prices remain supported by policy.

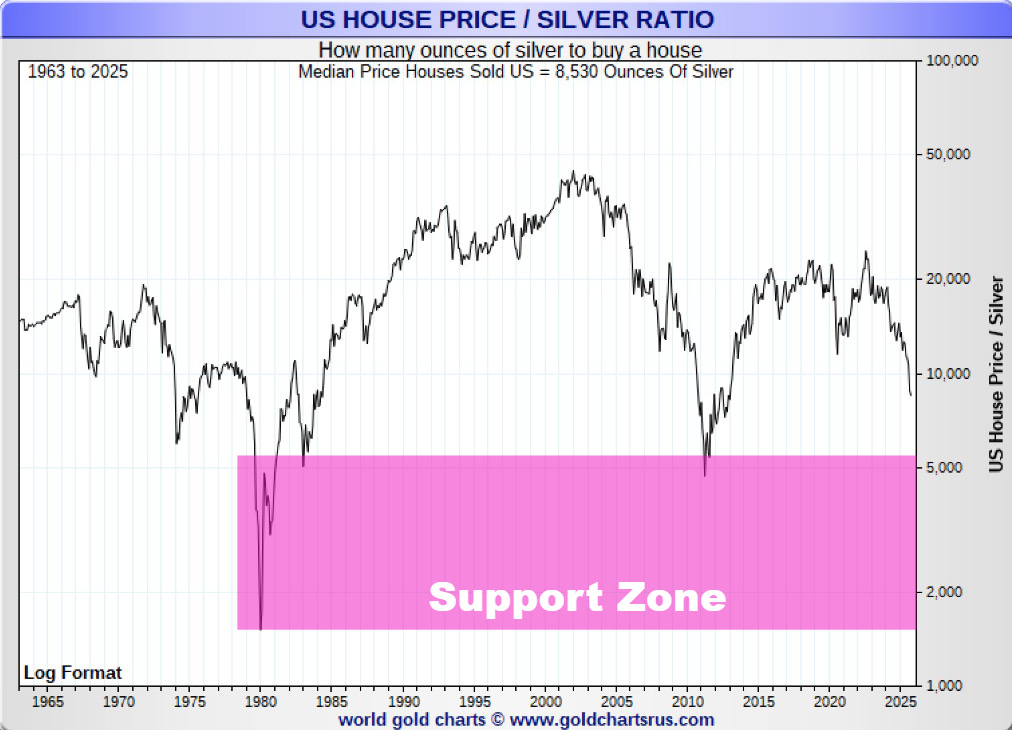

📊 U.S. Housing Priced in Silver (1963–2025)

Silver magnifies the cycle. Prior silver price peaks forced this ratio into the 2,000–3,000 oz (1980) and 4,000–5,500 oz (2011) support zones. The current compression toward the 5,000–7,000 oz range signals entry into the terminal phase of the real-estate cycle under currency debasement. A Euphoria phase that could even blow past historical support.

Translation:

Housing may hold in dollars, but it is already rolling over in real money. These ratios may not just return to prior lows… they could break through them in the final stage of speculative excess.

Today’s residential housing market is vastly more flexible on the supply side than in past centuries, while demographic turnover and leveraged excess sit in the background.

When monetary mania peaks, hard-money repricing rarely stops politely at historical support.

Commercial Real Estate: Policy Can Delay, Not Reverse

Commercial real estate is not simply cyclical… parts of it are structurally broken.

Office: secular decline

Retail: permanent bifurcation

Industrial: long-term strength

Multifamily: policy-only life support

Liquidity can slow the repricing, but it cannot restore demand where it no longer exists.

CRE is not rescued by the One Last Pump.

It is given one final inhale before long-duration repricing resumes.

The Deeper Signal

Real estate is no longer just shelter or yield.

It is becoming:

a currency hedge

a liquidity sponge

and a political asset class

But history is clear:

When the money changes, property does not simply rise… it is repriced relative to the new unit of account (Gold & Silver).

Nominal dollar prices can inflate indefinitely.

Real value cannot.

This cycle is no different.

🪙 4. Precious Metals: The Monetary Repricing Begins

Gold and silver are transitioning from hedges to neutral collateral as sovereign debt loses credibility.

Gold

Decouples from real rates

Follows global liquidity

Gains central bank bid

Anchors BRICS+ settlement

📊 Gold vs Global Liquidity M2 Money Supply

Gold consistently lags tightening, then violently reprices once monetary policy breaks and easing resumes.

Every major gold bull cycle since 1971 has followed this same sequence: rate hikes → system stress → policy reversal → gold acceleration → peak during the easing phase.

Today, gold relative to global liquidity is once again compressed beneath long-term resistance after the recent tightening regime… a setup that historically resolves with the next liquidity-driven surge. This is the structural setup for One Last Pump.

Silver

Silver is gold with leverage:

More volatile

More reflexive

More sensitive to liquidity

📊 Silver/Gold Ratio

The Silver/Gold ratio is breaking out of a decade-long downtrend on the monthly timeframe… a pattern that historically marks the transition from a gold-led phase into a late-cycle silver acceleration.

Each major silver bull market begins with this ratio escaping long-term compression.

If this breakout holds, it signals that silver is entering its leverage phase relative to gold… the classic signature of the final pump in a precious metals cycle.

For readers who want to see my full thesis on the Silver Bull Market, I’ve linked my Roadmap here:

Miners

If gold and silver are the monetary signal, miners are the amplifier. They don’t move first — they move last, and they move fast. In every major liquidity cycle since the 1970s, the sequence is the same:

Gold stabilizes

Silver accelerates

Miners detonate upward in a compressed window

That window opens when the market senses two things simultaneously:

The easing cycle is underway, and

The metals move is real, not narrative.

We are approaching that moment now.

For nearly a decade, miners have been stuck in a relative depression… underperforming gold, starved of capital, avoiding new projects, and forced into extreme discipline by a hostile cost of capital. That is exactly what creates the conditions for explosive upside: lean balance sheets, tight share structures, and operational leverage primed for a monetary shock.

And the shock is coming.

As liquidity returns, paper valuations expand first… but metals-backed cash flows expand far more. Miners turn optionality into torque. This is why they go vertical after gold breaks out — not before.

📊 Gold Miners vs Gold — The Leverage Trigger

After more than a decade of underperformance, the GDX/Gold ratio has broken a long-term downtrend and reclaimed the Ichimoku cloud. Historically, this pattern marks the transition from a gold-led phase into the leverage phase for miners. The next resistance zones show where relative momentum typically accelerates when liquidity returns.

This is the quiet part of the cycle… when gold is making headlines, but miners are still ignored. That’s how it always looks before they rip.

The setup today mirrors every prior miner supercycle:

Trendline break → regime shift

Cloud reclaim → structural reversal

Coiling under resistance → energy building

In liquidity-driven markets, miners don’t offer “beta.”

They offer convexity.

And in a world where sovereign debt is losing monetary credibility, that convexity isn’t just a trade — it becomes a hedge against the system itself.

Gold is the signal.

Silver is the acceleration.

Miners are the detonation.

The fuse is already lit.

For readers who want to see how I’m positioned for this cycle — including the portfolio that’s now +154% YTD… I’ve linked it here. 👇🏻

The New Magnificent Seven: My Gold & Silver Miners Portfolio Is Up +117% YTD

For centuries, empires have risen and fallen on the strength of their money, with gold and silver standing as the enduring roots and branches of true wealth… outlasting paper promises and collapsing political regimes.

⚡ 5. Commodities: Scarcity Becomes Collateral

In a multipolar world, commodities shift from goods → to financial collateral.

Expect:

higher structural energy prices

copper scarcity

uranium repricing

agricultural volatility

This is the commodity revaluation phase of the regime shift.

₿ 6. Bitcoin & Crypto: The Parallel Liquidity Engine

Bitcoin has become a proxy for global liquidity… a digital collateral asset for a new era.

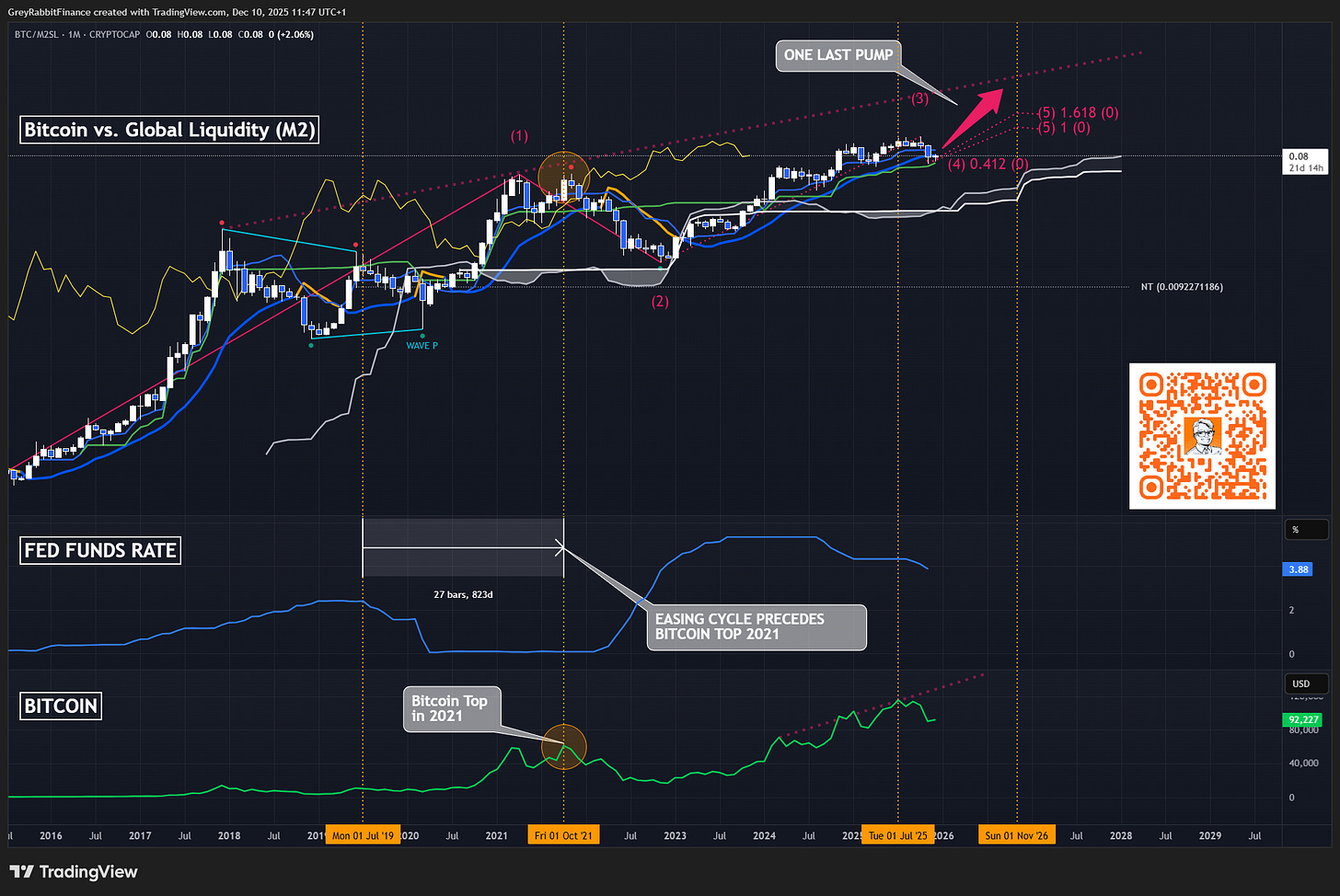

📊 Bitcoin vs Global Liquidity Index (M2)

Every major Bitcoin bull run has followed a global liquidity expansion. The 2021 top occurred after the largest easing wave in history, and today’s consolidation mirrors earlier pre-breakout structures. If the next liquidity cycle unfolds, Bitcoin has historically responded with a leveraged final impulse.

Stablecoins try to become the new eurodollar system.

Altcoins will melt up, then separate by utility. Most won’t make it out alive.

🎨 7. Scarcity Assets: The Wealth Preservation Pivot

Late-stage liquidity cycles don’t just inflate financial assets… they push capital into objects of scarcity. As trust in currency weakens and excess capital looks for permanence, money rotates into tangible status assets:

rare coins and numismatics

luxury watches

fine art

vintage collectibles

prime real estate

These aren’t yield trades.

They are wealth migration trades.

📊 Luxury Watch Index (Top Brands) 5-Year Liquidity Cycle

Luxury watch prices peaked almost precisely as global central banks began their most aggressive rate-hiking cycle in decades. The 2021–2022 blow-off coincided with zero-rate policy and peak liquidity. The multi-year decline that followed tracked tightening, dollar strength, and the collapse of speculative demand.

The recent stabilization reflects easing financial stress… but the prior peak remains a textbook example of how excess liquidity inflates discretionary luxury assets.

These markets act like pressure valves for excess capital during regime transitions.

When money no longer trusts the unit it’s measured in, it seeks:

history,

permanence,

and objects that cannot be printed.

In currency transitions, scarcity assets don’t behave like trades.

They behave like private vaults of value.

🌎 8. Central Banks Are Already Voting with Their Reserves

While markets debate the timing of the next Fed move, central banks aren’t waiting for confirmation. They are already reallocating reserves toward gold… quietly, consistently, and across both developed and emerging economies.

This is not speculative positioning.

This is sovereign balance-sheet behavior.

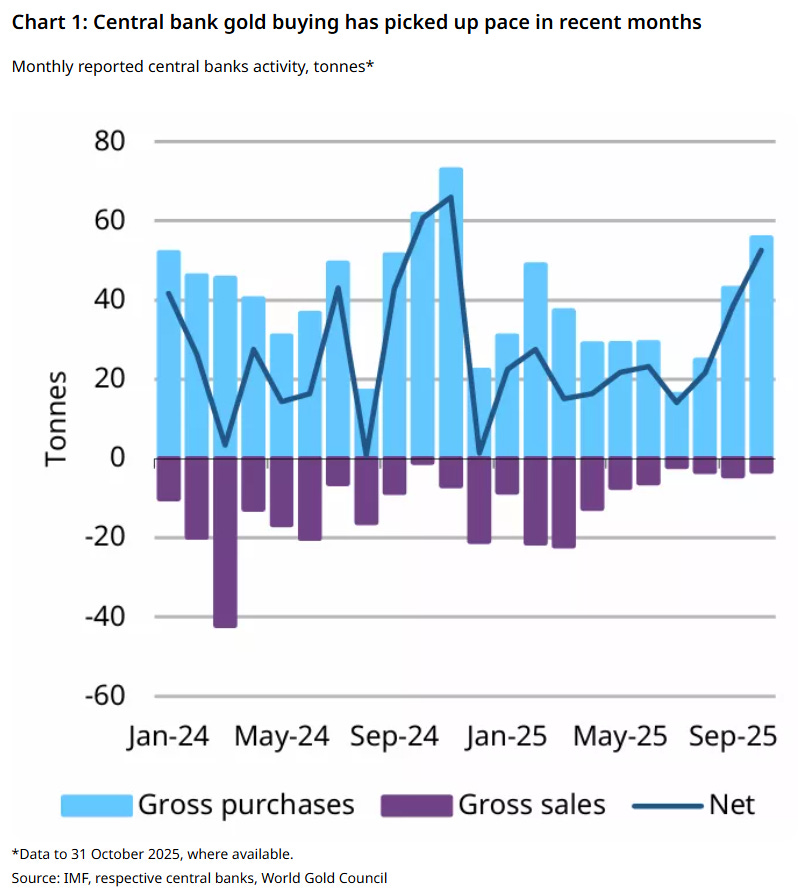

Over the past year, reported central bank gold activity has shown a clear acceleration in net purchases, with only brief, tactical periods of net selling. The trend is unmistakable: gold is being re-monetized at the reserve level, even as public policy language remains anchored to fiat stability.

📊 Central Bank Gold Activity (Monthly, 2024–2025)

Net central bank gold purchases have re-accelerated in recent months as gross buying overwhelms intermittent selling. This behavior reflects long-term reserve diversification, not short-term trading. Central banks are responding to monetary fragmentation by increasing their exposure to hard collateral.

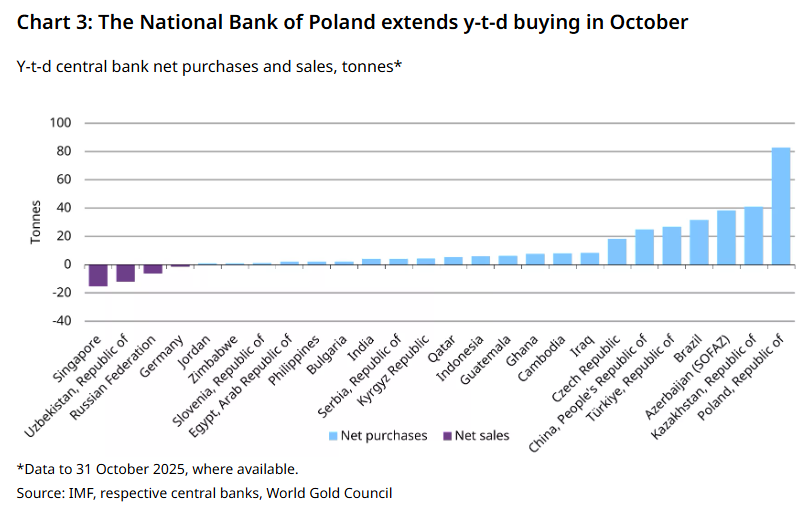

What’s even more revealing than the scale of buying is who is doing it.

The latest year-to-date data shows that gold accumulation is now being led by the BRICS sphere and its economic satellites — spanning Asia, the Middle East, Eastern Europe, and Latin America. These are not passive reserve adjustments. They are strategic hedges against currency volatility, sanctions risk, and dollar-centric settlement exposure.

This is gold being positioned as geopolitical collateral, not just a financial asset.

And while buying is broad-based, a few buyers still stand out.

📊 YTD Net Central Bank Gold Purchases by Country (to Oct 2025)

Gold accumulation is being driven primarily by the BRICS world and aligned emerging economies, with Poland emerging as a top buyer at the margin. This is not speculation… it is reserve architecture being rebuilt for a multipolar system. Monetary risk is being treated as permanent, not temporary.

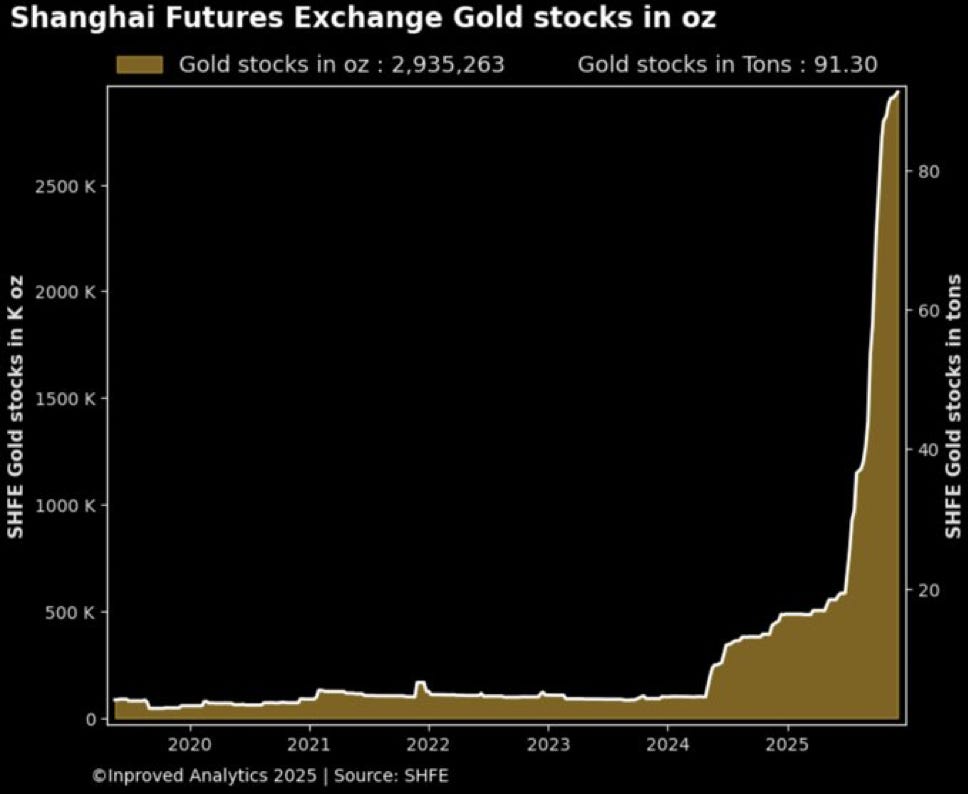

📊 Shanghai Futures Exchange (SHFE) Gold Stocks — Physical Accumulation Surge

Gold inventories on the Shanghai Futures Exchange (SHFE) have gone vertical in 2025, surpassing 91 metric tons held directly within China’s exchange vaulting system. This is not paper exposure… it is deliverable, domestically controlled metal accumulating at an accelerating pace. This is settlement-grade gold moving into the BRICS sphere.

Why This Matters for “One Last Pump”

Central banks don’t chase price.

They front-run regime change.

Their behavior tells us three things:

Trust in paper reserves is being quietly diluted

Precious Metals are re-entering the core reserve framework

The coming liquidity wave will land in a system already hedging itself

This matters because when public liquidity expansion meets private and sovereign demand for hard collateral, price no longer adjusts gradually.

It reprices structurally.

In past cycles, central banks were net sellers into gold strength.

This time, they are accelerating net purchases into monetary uncertainty… the opposite of every prior cycle.

That is not a topping signal for metals.

That is a foundation being laid under the next parabolic leg higher.

Final Thoughts from The Rabbit Hole 🐇

When you study markets long enough, the surface-level stories stop making sense.

The narratives from the big bank analysts, and legacy media break down.

The press conferences become theater.

And the data… the real data… tells a different story.

A stranger, more fragile, more revealing story.

That’s when you reach the bottom of the rabbit hole.

And down here, one truth becomes impossible to ignore:

The system isn’t designed to be stable.

It’s designed to be extended.

Reinforced.

Propped up.

Kept alive with ever-larger liquidity injections until the structure itself can no longer take one more pump.

We are at that moment now.

Bonds don’t function without intervention.

The dollar is losing neutrality.

Gold is returning as collateral.

And BRICS is building the first alternative settlement framework in decades.

Two worlds are forming:

The Old System — debt-backed money, financial engineering, suppressed volatility.

The New System — collateral-backed settlement, scarcity, multipolarity.

“One Last Pump” is the bridge between them.

It’s not the beginning of a new bull market.

It’s the final expansion of a regime running out of oxygen.

This last liquidity wave will distort, elevate, expose, and transition.

Many assets will soar nominally.

Others will sink.

All will reveal their true nature priced in Gold.

Our job isn’t to predict every move… it’s to recognize the shift.

Now the smoke signal is clear:

A rally that hides a transition.

A pump that marks an ending.

We are witnessing… The final flex of a dying monetary regime.

Stay sharp.

Stay prepared.

Stay Vigilant,

-Grey Rabbit

P.S. The system won’t warn you when the shift begins. But I will. Subscribe if you want the roadmap through the final liquidity cycle of this monetary era.

None of this matters , you already basically rent everything you own. You pay taxes ? You are renting . You deposit money in a bank ? You pay them to hold it for you . 401 k at work ? You pay . Ipen a business ? You pay for license to operate. Pay corporate or business tax as well as oersonal income tax. 1913 the money changers took over . Since then this country and world has been screwed. Relax its going to happen as it has been planned. There is no escape . The inmates identify with the abusers and defend them whatever political party they think they belong to. They are programed to think they are intellctually and morally superior to the other political party. Gaslighting 101.

Wow, these posts are epic