London’s Gold and Silver Vaults: What’s Really Going On?

Behind the LBMA’s Latest Data—Tariffs, Van Shortages, and a Skeptic’s Guide to the Numbers

Today, I tuned into the LBMA’s webinar on London’s gold and silver vault data, and let’s just say, it left me with more questions than answers. The explanations are out, and they’re… interesting.

LBMA Vault Numbers January 2025 Recap

Here’s what the LBMA reported for January 2025:

Gold:

8,535 tonnes (a 1.74% monthly decline).

Worth $771.6 billion.

Equals 682,772 gold bars.

Silver:

23,528 tonnes (an 8.6% monthly decline—the largest since records began in 2016).

Worth $23.9 billion.

Equals 784,282 silver bars.

The LBMA’s Explanation

The LBMA clarified in their February webinar that last month’s vault declines resulted from a combination of well-documented market dynamics, citing arbitrage and potential U.S. Tariffs as key factors driving the increased flow of metals from London to New York.

What exactly is Arbitrage?

Essentially, global gold prices are surpassing those in England, leading to the withdrawal of LBMA/BOE gold as prices adjust upward.

Buying Low, Selling High – Arbitrage is the practice of profiting from price differences in different markets.

Location-Based – Traders buy metal in one region (e.g., London) where it’s cheaper and sell it in another (e.g., New York) where it’s more expensive.

Time-Based – Some arbitrage strategies involve profiting from price changes over time, such as futures vs. spot prices.

Risk-Free (In Theory) – True arbitrage opportunities are low-risk, but costs like transport, taxes, and fees can eat into profits.

Market Efficiency – Arbitrage helps balance supply and demand, aligning prices across markets.

Impacted by Lease Rates – High lease rates can disrupt arbitrage by increasing the cost of holding and moving metal.

Rather than merely increasing BOE prices, recent claims of “logistics issues” and long delivery times (4-8 weeks) are being used an excuse to curb demand. As the LBMA continues to be drained, London's influence as the primary driver of global gold prices is deteriorating rapidly.

A 151-tonne drop in gold stocks? Sure, that’s “unsurprising,” they say. Silver’s 8.6% decline is blamed on the same trend, driven by US tariff concerns which have recently been postponed until March 2025.

But here’s the big surprise: despite the drop in silver tonnage, its USD value stayed pretty much the same month-over-month. How does that math work? The market’s disconnect has me thinking this rehypothecation house of cards is on the verge of collapse.

The Tariff Factor

The LBMA claims the gold outflows are mainly due to fears of US tariffs, and they don’t believe President Trump’s administration will actually impose them on precious metals. They claim the spike in lease rates is just a temporary shock due to this recent volatility.

What does the spike in lease rates mean?

When lease rates spike, it usually signals trouble in the metals market.

Higher Costs – Rising lease rates make borrowing metal more expensive, increasing costs for traders and institutions.

Supply Tightness – Spikes often signal reduced metal availability, leading to potential shortages.

Increased Volatility – Market uncertainty grows as traders adjust positions, causing price swings.

Arbitrage Disruptions – Traditional trading flows, especially between London and New York, can be thrown off balance.

Signs of Market Stress – Sharp increases may indicate liquidity issues, geopolitical risks, or broader financial instability.

Early Warning Signal – Watching lease rates can help spot market trouble before major price moves occur.

Let’s be honest: the LBMA doesn’t know for certain that the spike in lease rates is temporary. Actions speak louder than words, and so far, President Trump and Treasury Secretary Scott Bessent have been aggressively repatriating Gold to the US. Why?

Are they preparing for an audit that could lead to its re-monetization and use in their proposed US sovereign wealth fund? Is it in preparation for Basel III, with Gold receiving a new Tier 1 status? Clearly, it’s not just Arbitrage and Tariffs, although these are certainly accelerating the process.

Tinfoil Hat Time

Let me be frank: I thought the LBMA’s explanations felt a little too tidy. Gold stocks have been hovering between 8,540 and 8,775 tonnes for the past year, so January’s 8,535 tonnes isn’t exceptionally shocking. But what is truly shocking is something that is happening on the other side of the pond.

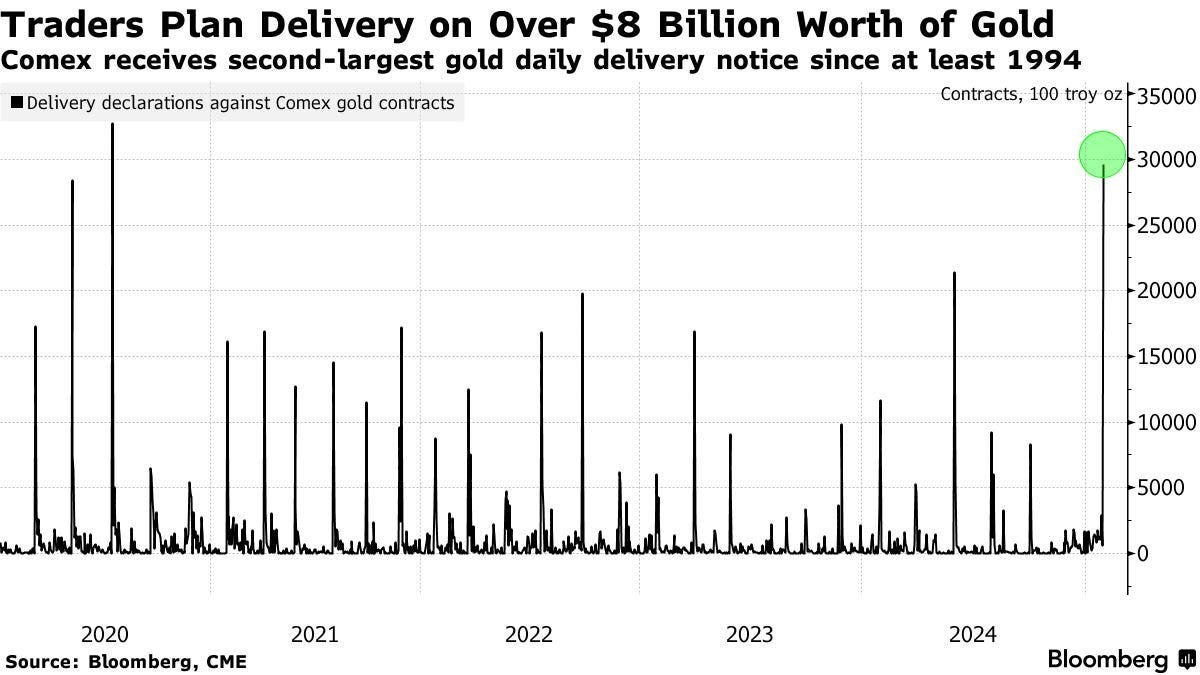

A big player is standing for delivery at the Comex at 15X the normal volume. The LBMA members didn’t have one peep to say about this or even attempt to speculate about anything other than “arbitrage or tariffs.” This truly has me wondering about their sincerity.

Especially after Ruth Crowell, LBMA’s Chief Executive, spoke about a shortage of “guys with vans” to move the gold. It's an alarming remark, and it hardly instills confidence in the logistics of an institution tasked with overseeing the trade of tonnes of precious metal.

Final Thoughts

The LBMA is pushing for greater transparency, with monthly vault data now published on the 5th business day of each month since 2017. That’s a step forward, but it doesn’t erase the lingering doubts. Are these numbers a true reflection of London’s vault holdings, or are they a cleverly managed PR exercise?

The LBMA insists the London market is functioning just fine, and that you haven’t been in the market long enough if you don’t understand these dynamics. But for those of us watching closely, the numbers—and the explanations—raise more questions than they answer.

Stay Vigilant.

-Tyler

What Do You Think?

Let us know what you really think is happening behind the scenes in the comments.

Can you rephrase your poll? You have an “or” in the question.

Sir, may I request an access link for the data source about the gold lease rate that you displayed in your post? Thank you