How US Tariffs Could Spark a Silver Short Squeeze

Trade Policy, Green Tech, and Market Mechanics Collide.

Imagine it’s 2025: US solar factories are humming, but they can’t source enough silver. Prices hit $50/oz, hedge funds scramble to cover shorts, and the COMEX threatens delivery defaults. This isn’t a dystopian fantasy—it’s a plausible scenario as US tariffs reshape global trade and industrial demand. Here’s why silver, the “devil’s metal,” could become the next battleground for investors, policymakers, and manufacturers.

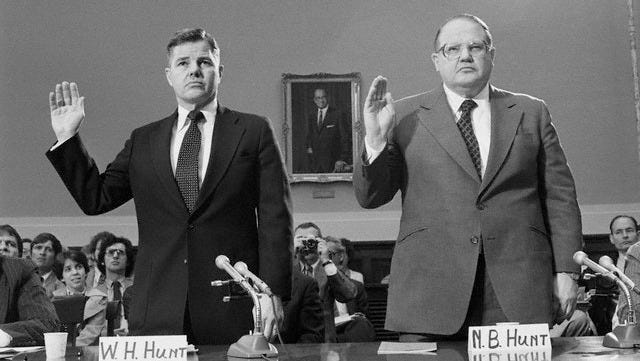

1. Historical Precedent: Lessons from Past Squeezes

Silver’s history is littered with volatility. In 1979–1980, the Hunt Brothers cornered the market, driving prices to $50/oz (over $200 today, adjusted for inflation). In 2021, Reddit traders targeted silver, but the rally fizzled due to weak industrial demand. Today is different:

Industrial Reliance: Over 50% of silver demand now comes from green tech and electronics, up from 40% in 2020.

Structural Deficit: The Silver Institute projects a 265M-ounce annual supply deficit through 2025—the largest in decades.

Key Takeaway: Past squeezes were speculative, but today’s is driven by real-world scarcity and fueled by large industrial nations—not just two brothers.

Source: Corbis

2. Tariffs as a Demand Catalyst

Recent US tariffs on Chinese EVs, solar panels, and semiconductors aim to reshore manufacturing. But domestic production requires more silver, faster:

Solar Panels: Each new US gigawatt (GW) of solar capacity needs ~20 metric tons of silver. With tariffs pushing domestic solar manufacturing to 100 GW/year by 2025 (up from 30 GW in 2023), demand could jump by 1,400 tons annually—enough to drain 10% of global mine supply.

Retaliation Risk: China produces 15% of the world’s silver and refines 50% of global supply. If Beijing restricts exports in response to tariffs, prices could spiral.

Mexico & Canada Sidelined: Mexico supplies 47% and Canada 18% of the U.S.'s silver imports. President Trump’s tariffs on these imports could raise prices, disrupt the supply chain, and increase costs for U.S. industries, potentially forcing the U.S. to seek alternatives or boost domestic production.

Source: SEIA

3. Inflation + Safe Havens: A Dual Tailwind

Tariffs are inherently inflationary. Rising input costs for EVs and renewables could push CPI higher, reviving silver’s role as a hedge:

1970s Redux: During the 1973–1982 inflation crisis, silver outperformed gold by 300%.

ETF Inflows: Physical silver ETFs like SLV hold 1.2B ounces—but could they handle a wave of redemptions? JPMorgan warned in 2023 that ETF liquidity is “tightening.”

Key Data Point: For every 1% rise in CPI, silver has historically gained 4–6% (World Bank, 2023).

4. The Short Squeeze Setup

The paper silver market is a house of cards:

Paper vs. Physical: As of January 2025, COMEX warehouses hold just 346M ounces of deliverable silver—enough to cover 3 months of industrial demand.

Record Shorts: Hedge funds hold 40,000+ net short contracts (CFTC data). A 20% price jump could trigger $5B in forced buying.

Mechanism:

Tariffs → US factories scramble for silver.

Physical buyers drain COMEX inventories.

Sellers can’t deliver metal, so futures contracts cash-settle at inflated prices.

Shorts panic, amplifying the rally.

Source: Trend Force

5. Wildcards: Policy and Psychology

Regulatory Intervention: The CFTC could impose position limits (as it did in 2020), but this might deepen distrust in paper markets.

Retail Frenzy: Reddit’s r/WallStreetSilver has 200K+ members. In 2021, they drove a 130% spike in silver coin sales. A tariff-driven shortage could reignite this base.

“The last squeeze was a dress rehearsal. This time, fundamentals are in the driver’s seat,” — David Morgan, metals analyst and author of The Silver Manifesto.

6. Risks to the Thesis

Substitution: Solar manufacturers could replace silver with copper or aluminum, but efficiency losses (up to 25%) make this a last resort.

Policy U-Turns: A US-China trade deal could ease tariffs, but reshoring momentum is bipartisan and likely irreversible.

7. Silver/USD Technical Chart - Weekly Timeframe

Current Silver Price: $31.61

Market Conditions: Short Term (9 Period): Ranging - Medium Term (26 Periods): Ranging - Long Term (52 Periods): Bullish Trend

Price was Supported: The $28.74 level and Kumo (Cloud) held as support.

Grey Rabbit LTI Indicator: About to turn Bullish

Grey Rabbit SMII Indicator: Gold Crossing (Bullish)

Forecast: I am expecting Silver to reach $38 between now and early Q2 2025. We need a Price close above the Resistance Level at $34.86 to confirm the move up, and end of consolidation phase.

8. Investor Playbook

Allocate 5–10%: Silver acts as both an inflation hedge and industrial bet.

Go Physical: Avoid paper markets (ETFs, futures) if delivery risk escalates.

Watch Triggers: COMEX inventory reports, US solar production data, and CFTC short positions.

Alternative: Platinum or copper for similar industrial exposure, but neither has silver’s monetary legacy.

Conclusion

The US-China trade war is no longer just about tariffs—it’s a fight for the critical minerals powering the 21st century. Silver sits at the crossroads of this conflict, vulnerable to policy missteps and market panic. While past squeezes were largely speculative, today’s is grounded in real-world scarcity and propelled by the influence of large industrial nations. It is time to sound the alarm…. We’re one supply shock away from chaos.

Final Questions:

Will policymakers realize they’re fueling a silver crisis—or double down on tariffs?

Your voice matters! Let us know what you think below.

Interested to learn more about forecasting the market with Ichimoku? Check out my book!

Click Here👉 At One Glance Book

Click Here👉 At One Glance Book

Data Sources Linked:

Subscribe for real-time analysis on trade wars and commodity shocks. Stay ahead of the silver squeeze.