How Fast Will Gold Revaluation Happen Globally?

The forces driving gold's resurgence—and why timing matters more than ever.

Gold has always been a symbol of wealth, stability, and power. But in today’s volatile economic climate, its role is shifting from a passive store of value to a potential cornerstone of global financial systems. With central banks stockpiling gold, geopolitical tensions rising, and the U.S. dollar’s dominance under scrutiny, the question isn’t if gold will be revalued—it’s how fast. In this post, we’ll explore the forces accelerating gold’s revaluation, including the impact of U.S. tariffs, China’s trade surplus, and the global shift toward precious metals. We’ll also examine why the West shouldn’t help China suppress silver prices and what this means for investors, governments, and everyday citizens.

1. Why Gold Revaluation Is Inevitable

Gold’s intrinsic value has been overshadowed by fiat currencies for decades, but cracks in the current system are becoming impossible to ignore. Here’s why revaluation is on the horizon:

Erosion of Trust in Fiat Currencies: Inflation, debt crises, and currency devaluations are eroding confidence in paper money.

Geopolitical Shifts: Countries like China, Russia, and India are aggressively accumulating gold, signaling a move away from dollar dependency.

Monetary Reset Talks: Rumblings of a Bretton Woods 3.0—a new global financial system—are growing louder, with gold likely playing a central role.

Gold isn’t just a relic of the past; it’s a hedge against an uncertain future.

2. The Catalysts for Rapid Revaluation

While gold’s revaluation seems inevitable, the speed at which it happens will depend on several key factors:

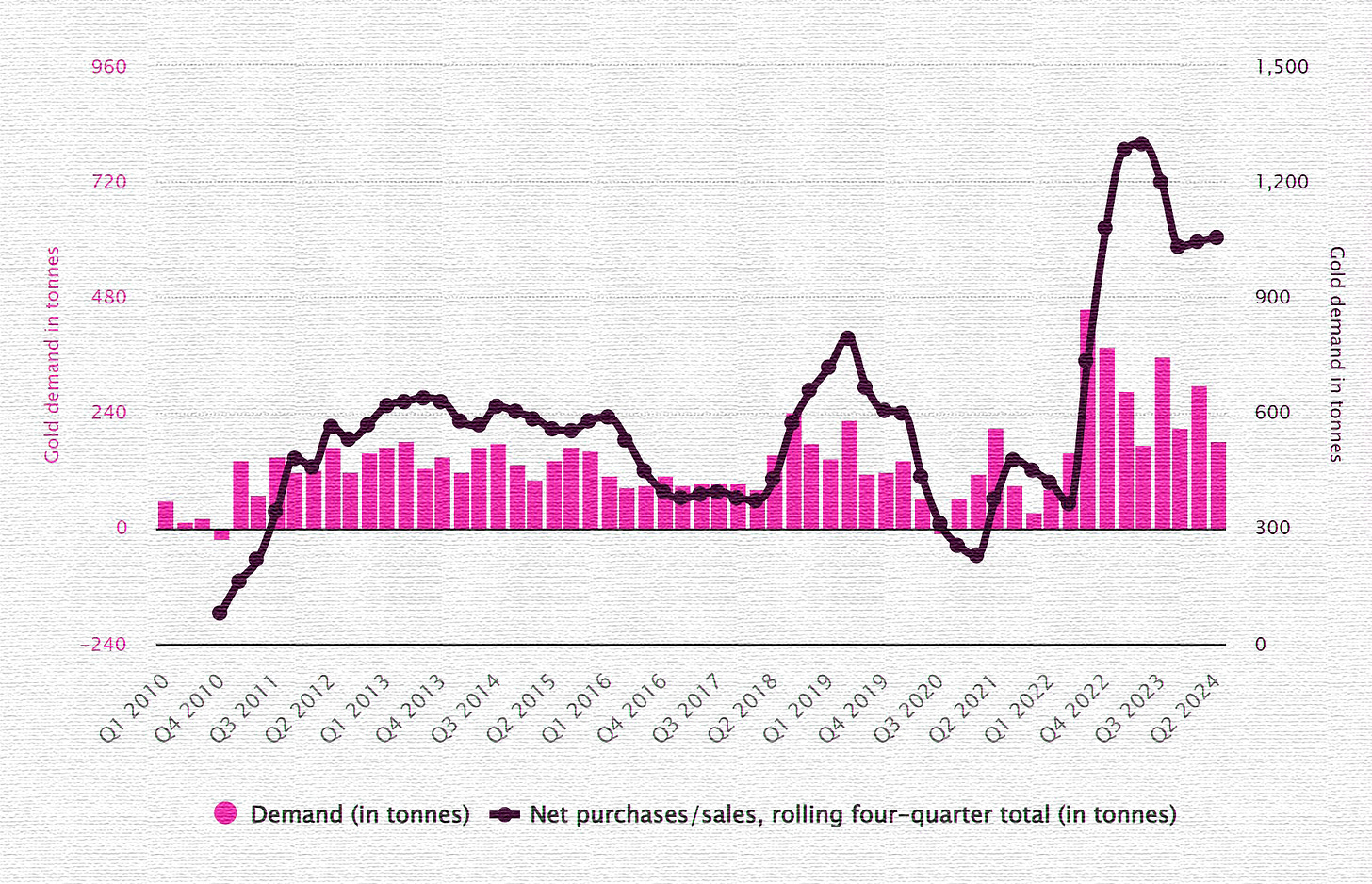

A. Central Bank Demand

Central banks have been net buyers of gold for over a decade, with 2022 seeing the highest purchases since 1967. This trend shows no signs of slowing, as nations seek to diversify reserves and reduce reliance on the U.S. dollar.

Total Central Bank Gold Demand 2024 (Globally)

Source: Statista

B. Dollar Devaluation

The U.S. dollar’s status as the world’s reserve currency is under threat. Rising debt levels, political instability, and the weaponization of the dollar in international trade are pushing countries to explore alternatives. A weaker dollar could accelerate gold’s revaluation.

C. Inflation and Economic Instability

As inflation remains stubbornly high in many parts of the world, gold’s role as an inflation hedge becomes more critical. Economic instability—whether from recessions, banking crises, or market crashes—could trigger a rush into gold, driving its price higher.

D. Technological and Industrial Demand

Beyond its monetary role, gold is essential in industries like electronics, renewable energy, and medicine. As demand grows, the competition for physical gold could push prices higher faster than expected.

3. How U.S. Tariffs and China’s Trade Surplus Could Affect the Precious Metals Market

U.S. tariffs, particularly on imports from major trading partners like China, could have significant ripple effects on the precious metals market. Here’s how:

A. Trade Wars and Safe-Haven Demand

Tariffs often escalate into trade wars, creating economic uncertainty. In such environments, investors flock to safe-haven assets like gold and silver. If U.S. tariffs lead to retaliatory measures or disrupt global trade, precious metals could see a surge in demand.

B. Supply Chain Disruptions

Tariffs can disrupt supply chains, increasing the cost of mining equipment, refining materials, and other inputs for precious metals production. This could constrain supply and push prices higher.

C. Currency Wars

Tariffs can weaken the U.S. dollar if trading partners reduce their dollar holdings in response. A weaker dollar typically boosts gold prices, as it takes more dollars to buy the same amount of gold.

D. China’s $1 Trillion Trade Surplus and Silver Stockpiling

China currently holds over a $1 trillion trade surplus, which it is using to roll out Chinese Sovereign Bonds and stockpile silver and gold. However, China has a vested interest in suppressing silver prices due to its heavy reliance on the metal for manufacturing, EVs, and high-end electronics. This creates a tension between China’s need for affordable silver and the global market’s upward pressure on prices.

The West should be cautious about continuing to suppress silver prices, as this could distort the market, harm miners/investors, and exacerbate the flow of precious metals to the East. Instead, the focus should be on ensuring fair pricing that reflects supply and demand dynamics.

Source: LBMA Vault Holdings

4. China’s Changing Outlook on Silver and Gold

China’s role in the precious metals market is evolving rapidly:

Silver Stockpiling: China is aggressively stockpiling silver to support its manufacturing and EV industries. However, its outlook on silver may change as global demand rises and supply deficits persist.

Gold Accumulation: As the world’s largest producer of gold, China is also a major buyer. Its Gold Accumulate Program established in 2010, allows citizens to buy gold in small increments (minimum 10 grams), with banks holding it 1:1. This program could significantly boost retail demand for gold.

Bond Issuance: China is about to release a 1.4 trillion yuan bond package, funded by its trade surplus. These long-duration sovereign bonds are part of a broader strategy to create a Eurodollar-like system outside of Washington’s control.

5. The Belt and Road Initiative and China’s Economic Ascent

China’s Belt and Road Initiative (BRI) represents 75% of the global population and over 50% of global GDP. Over the last 5-7 years, China has ramped up production of higher-quality goods like smartphones, EVs, solar panels, and high-end electronics, taking market share from Europe and Japan. This economic ascent is further solidifying China’s influence over global trade and finance.

6. The Perfect Storm for Precious Metals

The global precious metals market is facing a perfect storm of demand from both East and West:

Mining Supply Deficit: Since 2022, the mining supply of silver and gold has struggled to keep up with demand.

Western Tariffs: Proposed 10% tariffs on China and 25% tariffs on Mexico and Canada could further disrupt supply chains and drive prices higher.

Eastern Accumulation: China and other Eastern nations are stockpiling gold and silver as a hedge against dollar devaluation and economic instability.

Total Silver Market Supply Deficit 2024F

Source: Forecasted Data from Silver Institute's World Silver Survey 2024

7. The Role of Bitcoin and Crypto

While Bitcoin and cryptocurrencies are gaining traction in the West, they remain largely illegal in mainland China. Only Hong Kong allows crypto transactions, limiting its role in China’s financial system. This further underscores China’s reliance on gold and silver as alternative stores of value.

8. Judy Shelton’s Prediction: Gold Bonds by 2026

Judy Shelton, a prominent economist, has predicted that gold-backed bonds will be issued by July 4, 2026. This could mark a significant shift in the global financial system, with gold playing a central role in sovereign debt markets.

9. How Fast Could It Happen?

Predicting the exact timeline for gold’s revaluation is tricky, but here are three potential scenarios:

A. Gradual Revaluation (5-10 Years)

In this scenario, gold’s rise is steady but slow, driven by incremental shifts in central bank policies and gradual dollar devaluation. This would give markets and governments time to adapt.

B. Rapid Revaluation (1-3 Years)

A sudden loss of confidence in fiat currencies or a major geopolitical event (e.g., a global debt crisis or war) could trigger a rapid revaluation. In this case, gold prices could skyrocket almost overnight.

C. Hyper-Revaluation (Months)

In a worst-case scenario—such as a collapse of the dollar or a global financial meltdown—gold could become the de facto global currency in a matter of months. This would lead to an unprecedented surge in demand and price.

Come let us know what you think before the poll ends today!

10. What This Means for You

Whether gold’s revaluation happens gradually or overnight, the implications are profound:

Investors: Gold and silver should be core parts of any diversified portfolio. Consider physical metals, ETFs, or mining stocks.

Governments: Nations with large gold reserves will gain significant economic and geopolitical leverage.

Everyday Citizens: As currencies lose value, holding even small amounts of gold or silver could provide financial security.

The Bottom Line

Gold’s revaluation isn’t a matter of if but when—and the speed at which it happens will depend on a complex interplay of economic, political, and social factors. U.S. tariffs, China’s trade surplus, and the global shift toward precious metals are all critical pieces of the puzzle. While no one can predict the exact timeline, one thing is clear: gold’s role in the global financial system is about to change dramatically.

The question is, are you prepared?

What’s your take on gold’s future? Do you think U.S. tariffs and China’s trade surplus will accelerate or hinder its revaluation? Share your thoughts in the comments—or forward this to someone who needs to hear it. And if you’re not already subscribed, join us for more insights on the shifting global economy.

What we Don'T need is a Central Bank that will keep us shackled to a debt system once again. That chain HAS to be broken, no ifs, ands, or buts!

I am sure it will happen but I am also very concerned desperate governments will forcibly confiscate it from their citizens in the name of national interest.