The Flawed Sweetness of the Dollar Milkshake Theory

Why Physical Silver Will Emerge as the Ultimate Safe Haven.

The "Dollar Milkshake Theory," popularized by Brent Johnson of Santiago Capital, has captivated financial circles with its prediction of a dominant U.S. dollar siphoning global liquidity during economic turbulence. However, flaws in this theory are emerging, and its endgame—a sovereign debt crisis and systemic collapse—may ultimately reveal a different "milkshake": physical silver. Here’s why the dollar’s perceived invincibility is overhyped and how silver could outshine even gold as the ultimate store of value in a fractured global monetary system.

The Dollar Milkshake Theory: A Recap and Its Blind Spots

The theory posits that divergent monetary policies—specifically, the Fed’s tightening amid global easing—will strengthen the dollar as capital flees to U.S. assets, draining liquidity from other economies. While this narrative aligns with the dollar’s historical safe-haven status and the 2022 DXY surge, it overlooks critical vulnerabilities:

Unsustainable U.S. Debt: The U.S. national debt exceeds $36 trillion, and its ability to "print its way out" of obligations risks hyperinflation or loss of confidence, contradicting the theory’s assumption of perpetual dollar strength.

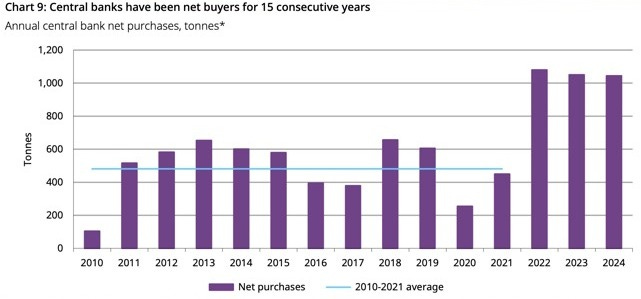

De-Dollarization Efforts: Countries like China and BRICS nations are actively reducing dollar reliance in trade and reserves, challenging the dollar’s hegemony. China established long duration Bonds essentially creating a Euro Dollar System not under control of Washington DC. China is also facilitating their companies and people to accumulate Gold: Gold Accumulate Program & 10 Major Insurance Companies Granted permission to buy Gold in Pilot Program. The insatiable appetite of central banks for gold (net buyers for the past 15 years) is working overtime to accelerate this decline in global US Dollar reserves.

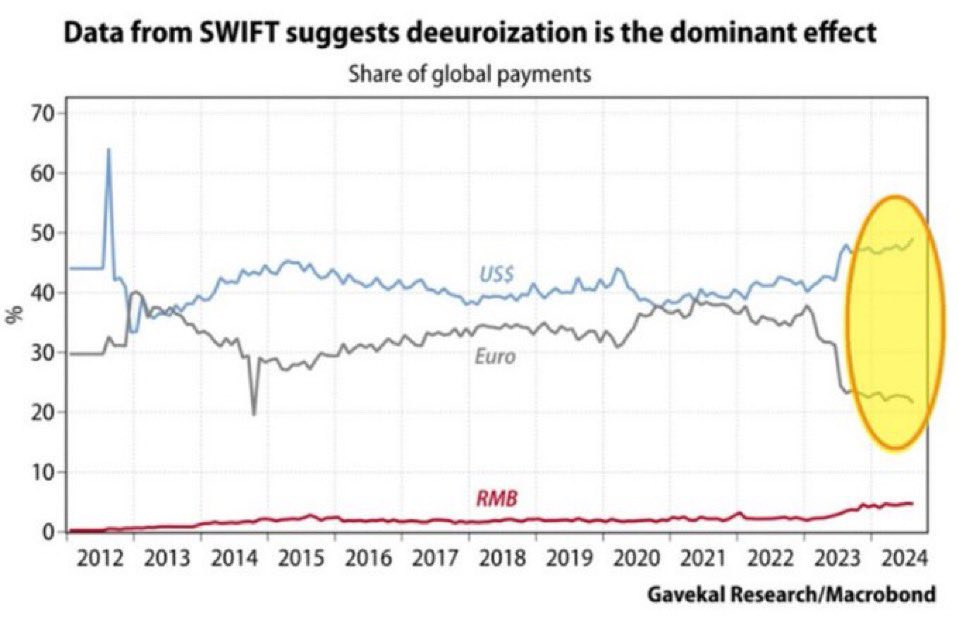

Network Effect Limitations: While 58% of global reserves are dollar-denominated, systemic shifts (e.g., CBDCs, commodity-backed currencies) could fragment this dominance. USD payments make up 49.1% globally, as Euro payments continue to fall.

Reliance on a Domino-like Currency Collapse: Countries with High debt to GDP ratios will most likely experience a collapse in their currency first, acting like a chain of dominos. Once these fiat currency dominos fall, demand for USD will propel the Dollar higher. Will other countries simply sit back and wait for their turn at a collapse, or will they actively seek alternative stores of wealth preservation?

Reliance on Price Suppression of Gold & Silver: Dollar Milkshake Theory claims the dollar will be the most attractive currency to store value, as it strengthens against other nations currencies. This attractiveness of saving in the US dollar relies heavily on rehypothecation and paper market manipulation to keep the precious metals prices artificially suppressed. Failing to maintain price suppression on metals, will initiate a tipping point, rendering the Dollar Milkshake temporary as smart money stampedes to even safer alternatives: Gold and Silver.

Critics argue the theory lacks empirical rigor and underestimates geopolitical shifts. In past debates, Brent Johnson argued that systemic de-dollarization without chaos is nearly impossible due to the entrenched dollar-based debt system. This we can both agree on. As trust in the current system erodes further, chaos will ultimately root itself deeper.

The problem is that Dollar Milkshake theory relies on:

Central Banks, Financial Institutions, Nations, and People to continue playing by the same rules and trusting in the system.

A gradual monetary system collapse or transition with limited chaos.

When things go sideways, is there really honor amongst thieves? How can we be certain the central banks, financial institutions and nations wouldn’t all act in self-interest? The same ones responsible for the rampant immorality of our current system. This is the glaring hole in the theory. Which leads me to believe that the Dollar Milkshake Theory is merely a temporary placeholder for the true milkshake—one that will start to take shape as the fraudulent paper markets for precious metals begin to unravel this year. Manifestations of this are beginning to appear at the epicenter of this rehypothecation, the London Bullion Market Association.

The Silver Surge: God’s Money Prevails over Man’s Paper Promises

When man’s Fiat monetary system becomes a liability, investors naturally flock to the universally recognized hard assets. Gold and Silver are the original sources of our monetary system, and all fiat eventually returns to its source. Almost poetic in a sense—like life and death. We’re born from the infinite and return to it when we die. As above, so below.

Gold and Silver are proven hedges against inflation, but physical silver offers unique advantages:

1. Industrial Demand Meets Monetary Heritage

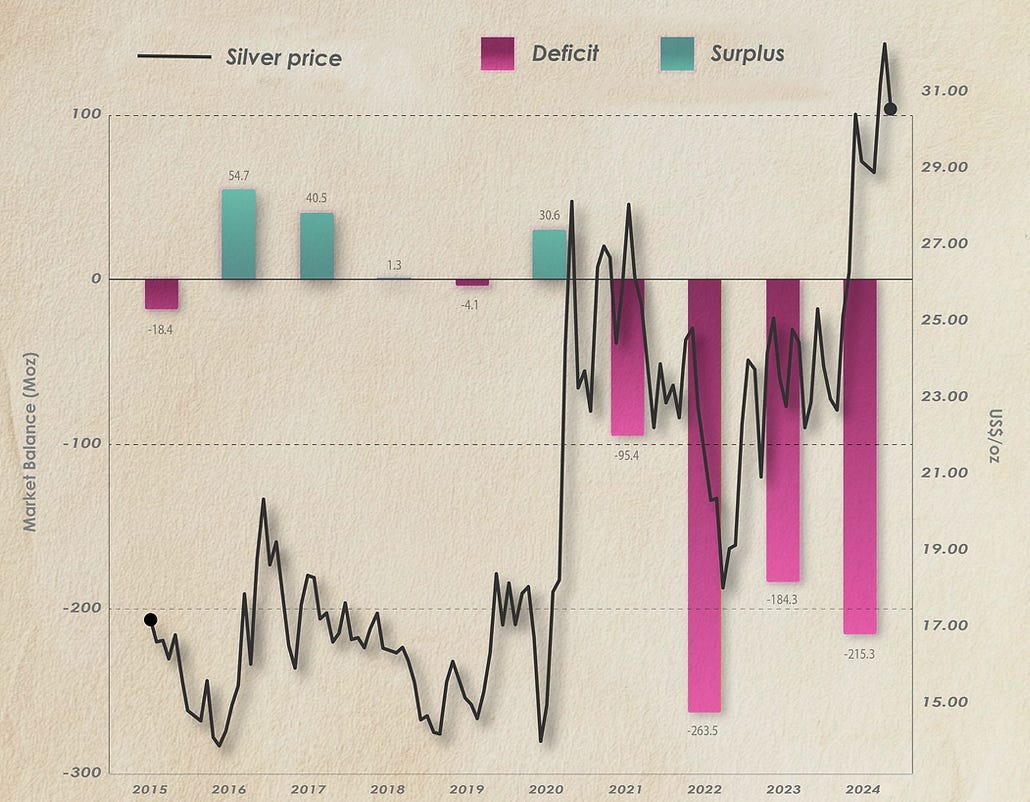

Silver is both a monetary metal and a key material in solar panels, electronics, weapons, and AI infrastructure, leading to a supply-demand squeeze. Industrial demand, making up 60% of supply, exceeds mine production, while investment demand continues to rise. Since 2021, silver has faced a supply deficit. Currently there are 28,000 metric tons of naked paper shorts—equal to a year’s worth of global mining output. Unlike gold, silver’s practical uses ensure steady demand even in economic downturns.

2. Undervalued Relative to Gold

The gold-to-silver ratio historically averages 15:1 but currently exceeds 90:1, suggesting silver is drastically undervalued. A reversion to the mean could trigger exponential gains, especially if monetary debasement accelerates.

3. Accessibility and Liquidity

Silver’s lower price point makes it accessible to retail investors, enabling broader participation during global crises. Physical silver (coins, bars) avoids counterparty risks inherent in ETFs or futures, a critical factor in a banking or currency collapse.

4. Hyperinflation Hedge

If the dollar’s strength morphs into hyperinflation (as warned by Ray Dalio), tangible assets like silver preserve purchasing power. During Weimar Germany’s collapse (1919-1923), precious metals retained value while paper money evaporated. Back then the Gold to Silver Ratio was in a more natural range between 1:17 (1919) and 1:31 (1923. Today, there is much more potential for Silver to outperform with a ratio of 1:90.

Source: www.macrotrends.net/1441/gold-to-silver-ratio

Why Silver Outshines the Dollar Milkshake’s Endgame

The Dollar Milkshake Theory’s climax—a liquidity crisis and debt defaults—would expose fiat currencies’ fragility. Brent Johnson ultimately thinks the system will be reset unilaterally from the Dollar’s Strength relative to other currencies. Here’s how silver prevails:

Collateral in a Broken System: Central banks hold gold, but silver’s scarcity and industrial ties make it irreplaceable. Monetary systems inherently favor tangible assets when trust erodes.

Dollar Overextension: A too-strong dollar crushes emerging markets, spiking inflation and social unrest. This volatility drives capital into metals, with silver’s volatility amplifying gains compared to gold.

Decentralized Safe Haven: Unlike Bitcoin, which relies on energy grids, digital fiat on/off ramps and internet access, silver requires no infrastructure—a critical edge in systemic blackouts or cyberattacks.

Sipping from a Silver Straw

The Dollar Milkshake Theory’s fatal flaw is its assumption of perpetual dollar primacy. As debt mounts, de-dollarization accelerates, and rehypothecation fails to suppress metals: the true "milkshake" will be the asset that combines scarcity, utility, and centuries of historical trust: physical silver. The tipping point will occur once it is no longer a feasible option for the West to continue artificially suppressing metals prices. While the paper dollar may temporarily suck liquidity, its long-term decline will leave investors thirsty for a tangible, enduring store of value.

In the end, people will awaken from their daze and rediscover a fundamental truth—by definition, a true Dollar is, and always has been, an ounce of physical Silver.

Stay Vigilant.

-Tyler

Nice job with your evaluation, now that more people are awakened their best bet is no 3rd party interaction to access their silver when needed.

I wish you well.

A silver dollar contains 0.7734 ozt of silver. As per the Coinage Act of 1792.