Tell Your Mom to Buy More Silver: How the Banksters Could Trigger a Historic Short Squeeze—and Why You Need Physical Metals Now

With LBMA Vaults Hemorrhaging Silver and Gold, Here’s How Much You Need to Escape the Paper Trap

If you think the silver market is just a playground for Wall Street elites, think again. The “Banksters” (a cheeky term for the big banks and bullion traders) are quietly cornered in a high-stakes game of financial Jenga. Their COMEX gold and silver short positions—betting prices will fall—are teetering, and their escape routes are narrowing. When this tower collapses, it could send precious metals prices soaring. Here’s why your mom (and you) need to own physical silver and gold before the dam breaks.

The Banksters’ Three Escape Routes—and Why They’re Failing

To close their massive COMEX shorts, the Banksters rely on three tactics:

Exchange for Physical Cash Settlements

Paying cash instead of delivering metal—if buyers agree. But trust in paper promises is evaporating.

Exchange for Physical Delivery

Handing over real gold or silver from LBMA vaults. Problem? London’s vaults are bleeding inventory.

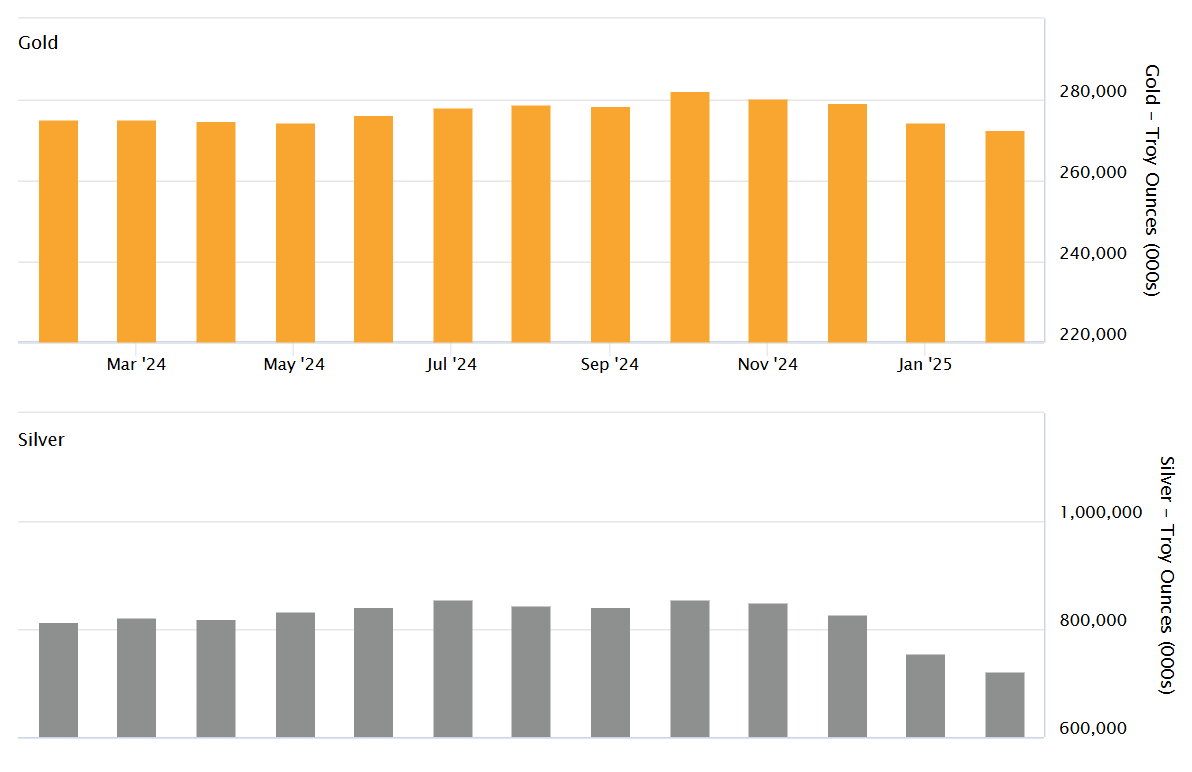

- As of February 2025, LBMA gold holdings fell to 8,477 tonnes (a 0.68% monthly drop), worth $772.5 billion. That’s just 687,142 gold bars.

- Silver collapsed to 22,462 tonnes (a 4.5% monthly plunge), valued at $22.5 billion—roughly 748,738 silver bars.

Critical detail: While the Bank of England’s gold reserves shrank (moved into commercial vaults), silver outflows slowed slightly. But the trend remains dire: London’s physical stockpiles are shrinking faster than replacements arrive.

Paper Short Covering (The “Nuclear Option”)

Buying COMEX long contracts to offset shorts. This doesn’t touch physical metal but forces prices upward as algorithms panic. This is the short squeeze trigger. The Banksters avoid this until desperate—because it could detonate prices.

Why the Short Squeeze Is Now Inevitable

The Banksters’ first two options depend on physical metal they no longer control. February’s LBMA data reveals the cracks:

- Silver inventories dropped 4.5% in one month—a rate that would empty vaults in under two years.

- Gold’s 0.68% decline masks a larger story: Metal is shifting from central banks (BoE) to commercial vaults, masking scarcity.

Meanwhile, the LBMA’s new transparency efforts—publishing monthly vault stats—confirm what stackers already know: The physical market is being cannibalized to prop up paper claims. When the disconnect between paper and reality snaps, prices will explode.

How Much Gold and Silver Do You Need to Be in the Top 1%, 5%, or 20%?

With LBMA vaults dwindling, physical ownership is your lifeline. Here’s the breakdown:

- Top 20%: Own 50 oz of silver + 2 oz of gold—enough to hedge inflation and bank crises.

- Top 5%: Hold 200 oz of silver + 10 oz of gold—insulation against systemic collapse.

- Top 1%: Secure 1,000+ oz of silver + 50+ oz of gold—generational wealth when fiat resets.

Remember: Over 80% of people own zero physical metals. Even 50 oz of silver puts you well ahead of the herd.

What to Do Now

1. Buy Physical—Not Paper. Focus on sovereign coins (Eagles, Maples) or 1kg bars. Avoid ETFs—they’re claims on dying vaults.

2. Store Outside the System. Use a home safe, private vault, or non-LBMA jurisdiction.

3. Warn Your Mom. Send her this article. Then help her buy. Click the Share button below. 👇

Final Thoughts

The Banksters are playing a dangerous game, and their exit strategy will reshape the precious metals landscape. When the short squeeze hits, the price fireworks will be spectacular—but only those with physical metal will reap the rewards. Don’t wait for CNBC headlines. Buy silver. Buy gold. And yes, please remember to tell your mom.

Stay her favorite,

-Tyler

P.S. The LBMA’s February 2025 data isn’t a typo—it’s a warning. At this pace, the vaults will hit zero.